2013 market outlook: Builders expecting big things

by David Barista

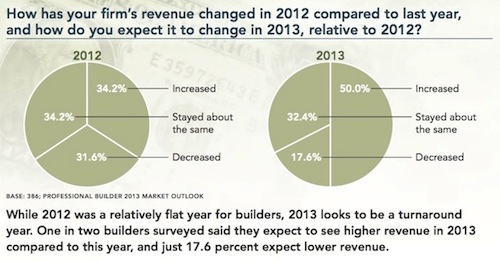

Following a mostly flat 2012, home builders are projecting higher revenue and more home sales next year.

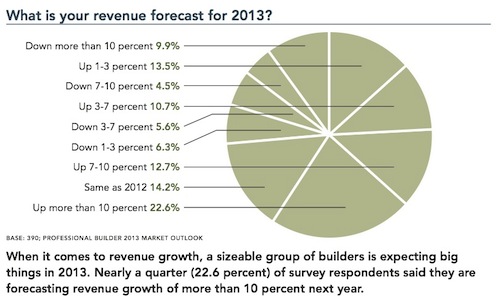

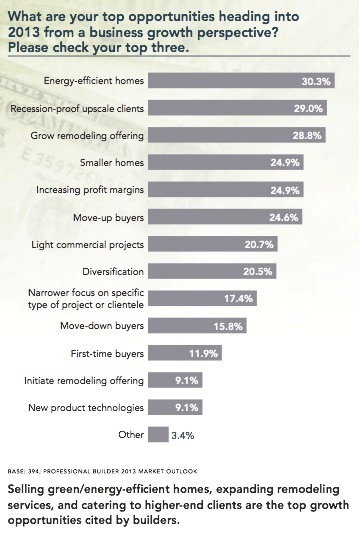

As the nation’s economy sputters back to life, home builders across the country are finally seeing light at the end of the tunnel and are expecting to see solid gains in 2013. Of the 400 builders that completed our recent 2013 Market Outlook survey, exactly half said they expect to see higher revenue next year compared to 2012, and nearly a quarter (22.6 percent) said they are forecasting annual revenue gains of 10 percent or more.

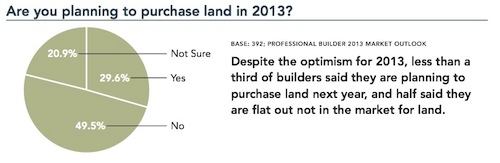

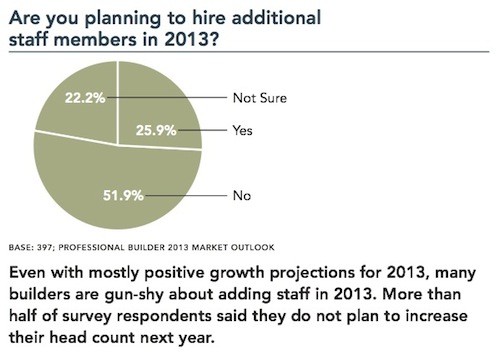

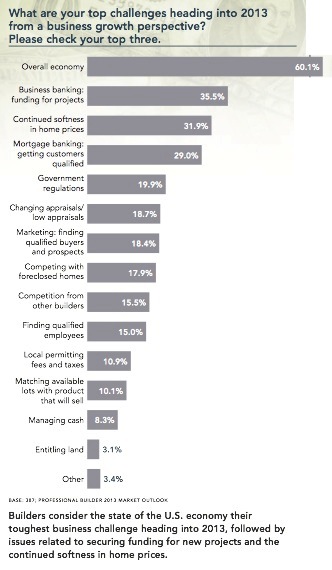

But builders fully admit that they’re not out of the woods yet. Top challenges cited by survey respondents include the overall economy (60.1 percent indicated it was one of their top-three obstacles); project funding (35.5 percent); continued softness in home prices (31.9 percent); and getting customers qualified for a mortgage (29.0 percent). For more survey results, see the charts below.

Methodology and Respondent Information

This survey was distributed in November 2012 to 86,054 Professional Builder readers. No incentive was offered. By the closing date, a total of 400 eligible readers had responded. Respondent breakdown by discipline: 49.1 percent single-family home builder; 26.6 percent diversified builder/remodeler; 9.8 percent designer/architect; 3.5 percent multi-family builder; and 1.5 percent systems builder; and 9.5 percent “other.”

Housing Recovery Depends on Slashing Mortgage Debt

by Diana Olick

Rising home prices are the foundation of today’s housing recovery. They are drawing much-needed buyers back to the market. Prices would not be rising if the number of foreclosures wasn’t falling. They also wouldn’t be rising without underwater borrowers getting a break from their banks. Both of those are happening because banks are slashing the balances of thousands of mortgages and letting homeowners sell for less than the value of their loans rather than going to foreclosure.

That debt forgiveness is currently not taxable, thanks to a law passed five years ago which expires at the end of this year. There is bipartisan support to extend that law, but so far any action has been mired in stickier negotiations surrounding the so-called “fiscal cliff.”

“The prospect of being taxed on potentially tens or hundreds of thousands of dollars in additional income may motivate more distressed homeowners to forgo a short sale and allow the home to be foreclosed,” said RealtyTrac’s Daren Blomquist in a release. “Additionally, if the mortgage interest deduction is eliminated due to the fiscal cliff quagmire, it would give many underwater and otherwise distressed homeowners one less reason to hang on to their homes.”

Banks completed 13,351 principal reduction loan modifications in November alone, according to a monthly report from Amherst Securities Group. That’s a 62 percent jump from September. Much of it is thanks to the $25 billion mortgage servicing settlement signed by the nation’s five largest banks early this year over so-called “robo-signing” foreclosure practices.

Banks have already given borrowers $6.3 billion in mortgage principal relief under the settlement, according to a report from its monitor, Joseph A. Smith, released last month. Bank of America recently ramped-up its relief, reporting 30,000 customers were approved or had completed first-lien modifications through September 30 providing $4.75 billion in principal reduction. Borrowers received an average $150,000 slash in loan balances.

Short sales, another form of principal forgiveness, are also surging. 98,125 homes were sold for less than the value of the mortgage during the third quarter of this year, according to a new report from RealtyTrac. Short sales of properties not facing foreclosure also jumped 15 percent from the previous quarter.

Why is this key to prices?

For one, properties in a short sale garner far higher prices than comparable homes that have been through foreclosure and are bank-owned. Short sales can still lower the value of homes around them, but not nearly as badly as foreclosures.

Principal reduction loan modifications help to stabilize home prices because they bring underwater borrowers into or closer to a positive equity position, drastically reducing the probability of a loan default and ultimate foreclosure. Principal reduction loan modifications have a far lower re-default rate than modifications that just extend the term of the loan or lower the interest rate.

During a Senate Banking Committee hearing Thursday, Secretary of Housing and Urban Development Shaun Donovan told the panel that extending tax relief on debt forgiveness is “a high priority,” but could make no promises.

Passing the Baton: Will plastics be the new structural building material?

By John Caulfield

Every year, trillions of tons of plastic-made products—the bulk of which is shopping bags, obsolete electronics, and empty water bottles—get dumped into landfills worldwide. So far, recycling efforts have made barely a dent in this waste pile. But that might change if recycled plastic were to emerge as a core structural component for new-home construction.

To those builders and suppliers who say “don’t hold your breath,” one academic who has spent his career working with recycled plastic responds confidently that this evolution is coming. Dr. Tom Nosker of Rutgers University invented a structural composite material made from 100 percent recycled plastic that Axion International now uses to make railroad ties and bridges. Nosker predicts it is “very likely” that recycled plastics will be used more widely to build homes.

“It’s only a matter of time,” he tells Builder. “Recycled polyethylene has great mechanical properties and is strong as hell. But it’s all going to be about politics.” He notes that some countries already ban wood from being used in structures. With Canada exporting more lumber to China than it does to the U.S., the availability and price of wood for construction becomes less predictable. And plastics should get cheaper as the gap between oil and natural gas prices closes.

Indeed, the media have given recent attempts to use recycled plastic as a structural component in home building widespread publicity. A case in point was the opening in Haiti recently of a manufacturing plant devoted to mass-producing bales of compacted recycled plastic bound by wire. The process was developed by Texas-based Ubuntu-Blox, which in June completed a house in Haiti made from about 600 bales.

Wales-based R&D firm Affresol is into the fifth stage of developing its synthetic concrete product Thermo Poly Rock (TPR), whose content is 70 percent recycled plastic. Ian McPherson, Affresol’s managing director, says his company plans to roll out 400 house frames made from TPR next year.

Affresol’s process mixes granulated plastic waste with a mineral/resin compound. The finished product—which pours like concrete and dries in 2½ hours—is produced for about 12 percent less than standard bricks or blocks, and doesn’t have anywhere near the carbon footprint of composites made from plastics melted at high temperatures.

McPherson sees the U.S. becoming “one of the biggest market opportunities for us” because, he believes, TPR can deliver the benefits of wood framing (i.e., quick construction), and the durability of brick and block. “Our product doesn’t replace concrete; it’s a sustainable alternative,” he says.

Alternative Measure Sees More People Living in Poverty

By Ben Casselman

There were 46.2 million people living in poverty in America last year. Unless there were 49.7 million.

Earlier this fall, the Census Bureau released its annual look at poverty in the U.S. According to that report, there were 46.2 million people in 2011 living below the poverty line of about $23,000 for a family of four. The official poverty rate was 15.0%.

But on Wednesday, the Census put out another report showing that the official figures leave out some 3.5 million people whom many experts argue should properly be counted as “poor.” If those people were included, the poverty rate would be 16.1%.

The difference comes down to definitions. The government’s official definition of poverty dates back to the 1960s, when economist Mollie Orshansky drew the poverty line at three times the cost of a minimal diet. That figure, updated for inflation, has remained more or less unchanged ever since.

Economists have argued for years that the official definition of poverty manages to be both too broad and too narrow. Because it looks only at pretax income, the official rate ignores all sorts of government programs — including food stamps, Social Security, subsidized housing and various tax credits — that help keep families out of poverty. But it also fails to account for taxes, transportation costs, child and health-care bills and other expenses that eat into disposable income. And because the poverty line is the same across the country, it fails to account for huge regional differences in the cost of living, especially when it comes to housing.

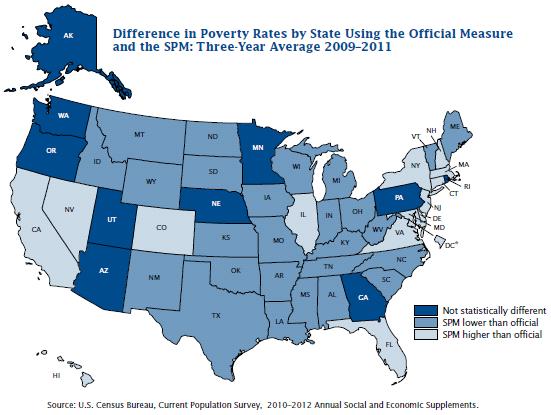

The alternative, or “supplemental,” poverty measure released Wednesday attempts to account for those criticisms. The supplemental measure, which the Census Bureau released for the first time last year, doesn’t look that different from the official rate on a national level, and neither definition shows much change in 2011 from 2010. But for certain groups, the different definitions make a much bigger difference.

Under the official definition, for example, there are 16.5 million children under 18 living in poverty, for a poverty rate of 22.3%. But because many government antipoverty programs target children, the alternative definition yields a lower rate of 18.1%, a difference of more than 3 million people.

Among seniors, however, the updated definition has the opposite effect, yielding a poverty rate of 15.1%, far higher than the official rate of 8.7%. What accounts for the difference? Out-of-pocket medical expenses, which aren’t accounted for in the official rate but push nearly 3 million seniors into poverty.

Wednesday’s report for the first time provides a state-by-state look at the new poverty measure. There too the effect of the new approach varies. Mississippi’s worst-in-the-nation 21.1% poverty rate would be just 15.8% — still high, but better than several other states including New York and Texas. (The state-level data are based on three-year averages.) Nevada’s poverty rate, however, would rise to 19.4% from an official rate of 15.1%.

Poverty numbers can be a politically fraught topic, with conservatives arguing that most definitions are overbroad, including people who aren’t poor once government benefits are taken into account, and liberals arguing they are too narrow, underestimate living expenses, especially for families with children.

But Columbia University Professor Jane Waldfogel says the strength of the new Census approach is its transparency. The report lays out how various programs and assumptions effect its calculations — and what the poverty rate would look like if they were left out.

“You can see exactly what the effect of the different antipoverty programs is,” Ms. Waldfogel says. “We just need to be clear what we’re measuring when we’re measuring poverty.”

Renters find options pricey after Sandy

By Andrea Rumbaugh, The Asbury Park (N.J.) Press

11:32AM EST November 14. 2012 – Within a span of 15 minutes, superstorm Sandy flooded the apartment Jillian Cantor rented at Holiday on the Bay in Toms River.

Cantor, 33, and her boyfriend Michael Aranowicz, 36, tried to move their possessions upstairs, but they couldn’t stop the water from seeping into their home. It destroyed most of the belongings downstairs and everything in their shed, where the couple kept fishing poles, family memorabilia and Hanukkah decorations.

“As a renter, it’s the worst thing that can happen to you,” she said.

The apartment was declared uninhabitable, and Cantor was forced to find a new dwelling. Luckily, a friend’s boyfriend had a place they could move into for a few months.

And like Cantor, many renters are finding it both difficult and expensive to find a new home in the wake of Sandy.

“This crisis exacerbates and makes clear the question: Where do people go?” said Arnold Cohen, policy coordinator for the Housing and Community Development Network of New Jersey.

Along the Jersey Shore, Cohen said there are two types of tenants.

The majority are year-round renters who make the area their permanent homes. For these tenants, relocating is a concern because they don’t want to leave their communities or uproot their kids from school.

“It’s really devastating because there’s a lack of rental housing,” he said, “so if they lose what they have, it’s going to be difficult to find a place to live in a community that’s home to them.”

He said the second type of renter is receiving emergency assistance, which is a state program that gives housing assistance to those who would otherwise be homeless.

People on emergency assistance often stay in hotels that offer reduced prices during the winter. However, Cohen is concerned these tenants will be kicked out so hotels can attract other displaced residents who can pay higher prices for housing.

“It would increase homelessness and that also has a cost for society as a whole,” Cohen said.

And relocating as a renter can be expensive — especially since tenants often don’t have renter’s insurance.

“Renters are usually the most vulnerable,” said Ed Dowling, owner of Edward R. Dowling Insurance Agency in West Long Branch.

Those with renter’s insurance might receive additional living expenses if displaced, but these coverages only extend to certain events —and displacement due to flooding is excluded, he said.

In fact, Dowling said there is no way for renters to receive additional living expenses due to flooding because it’s an excluded insured loss. Tenants can buy additional flood protection for their belongings but not for their relocation fees.

“There is technically a gap in there, or hole, in the coverages,” he said.

Marshall McKnight, spokesman for the New Jersey Department of Banking and Insurance, said the standard renter’s insurance policy focuses on a person’s contents and expenses for being displaced during covered events, like wind and fire.

Cantor had renter’s insurance, but she did not have flood coverage. And while the insurance company initially denied the claim, they later reopened it. Cantor hasn’t heard from them since — despite leaving multiple phone messages and e-mails.

She was also denied by the Federal Emergency Management Agency for having insufficient damage, yet she believes there is about $10,000 worth of damages.

“We got denied basically the same day,” she said. “I don’t see how losing your car is insufficient damage.”

On Wednesday, FEMA announced its decision to increase the amount of rental assistance for eligible disaster survivors in New York and New Jersey.

“The rental amount, based on existing HUD Fair Market Rates (FMR) for fiscal 2013, is being increased by an additional 25 percent,” FEMA said in a statement. This increase is expected to make an additional 1,200 rental resources available for the temporary housing of disaster-impacted families in New Jersey.

Yet, Cantor misses her home in Toms River. She would like to find another place in that area, or maybe a little north, but she will not live by the water again.

“No more water,” she said. “I think I’ve seen enough to last a lifetime.”

International Buyers: O, Say, Can You Ski?

By SANETTE TANAKA, WALL STREET JOURNAL

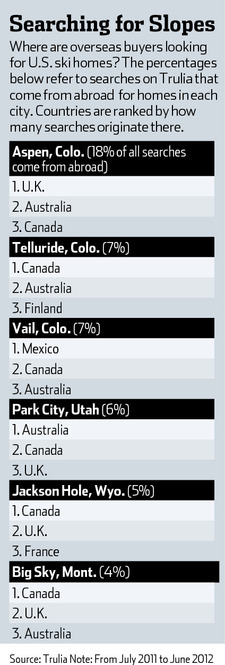

Where do home buyers from foreign countries go to hit the slopes? The British love Aspen, Colo. Canadians seek out Big Sky, Mont. And Aussies flip for Park City, Utah.

Those are three of the top ski destinations in the U.S. that were searched online from abroad between July 2011 and June 2012, according to real-estate website Trulia .

In the Trulia analysis of six ski areas—Aspen, Vail and Telluride in Colorado; Jackson Hole, Wyo., Big Sky and Park City—five see the most views from Canada, the U.K. and Australia. But Vail, Colo., sees the most traffic from Mexico.

Foreign buyers tend to zero in on properties that are amenity-rich, as the properties are usually a second or third home. Rustic log cabins and ski-in-ski-out mountain chalets are at the top of their wish lists, says Lisa Delaney, vice president of marketing for Jackson Hole Sotheby’s International Realty.

Ms. Delaney says the international client base for Jackson Hole has grown nearly 10% over the past year.

“You used to go to the ski areas and only hear English,” she says. “Now you hear all sorts of languages. It really feels like an international resort.”

According to Trulia, France ranks No. 3 in top foreign views for Jackson Hole.

David Bernand moved from Saint-André-d’Apchon, France, to the U.S. in 1999 and eventually settled in a two-story log cabin in Jackson Hole. For ski lovers like Mr. Bernand, Jackson Hole is particularly appealing because its rugged landscape is similar to the Alps.

“The way it looks, with the mountains, pine trees and wildlife, is exactly like France,” he says. “It looks like the Alps in many ways, but here it’s steeper. The Alps have more layers of mountain between the valleys.”

Mr. Bernand, general manager of Four Seasons Resort Jackson Hole, estimates about 30 French countrymen live nearby.

Park City, Utah, came on the international map after nearby Salt Lake City hosted the 2002 Winter Olympics. That publicity, plus direct flights from Los Angeles, Vancouver and Paris, made it a popular destination for foreign investors, says David Johnson, managing broker at Summit Sotheby’s International Realty.

But the trend of foreign lookers overall is on the downswing, says Jed Kolko, chief economist and head of analytics at Trulia. Foreign investors are attracted to bargains, he says. “We find that as prices are rising in the U.S., the share of searches coming from foreigners is actually going down.”