That Sucking Sound You Hear: Solutions to America’s Housing Crisis Are Needed

by Richey Piiparinen 02/15/2013 – New Geography

There is a crisis in America that’s not being attended to. It is the housing crisis, and its tentacles reach deep into the decline of the American middle class. Particularly, the interlocking dynamics of foreclosure, abandonment, and blight are draining the net worth of millions of Americans. The solutions to date have been piecemeal and ineffective. One possible initiative on the radar—which will be explained further below—entails a federal investment in the strategic demolishing of thousands of “zombie properties” that are eroding equity and quality of life.

This erosion is real. Writes Howie Kahn of his recent tour with a City of Detroit demolition crew:

Old roofs half-collapse under the weight of snow, forcing the walls to bulge outward. Moisture eats away the insides. Mold spoils the walls, softens the floors. In the summer, the sun bakes it all to a high stink and turns it crisp as tinder. Nature takes over. Trees sprout through the dormers. Animals get comfortable. We see this everywhere we go…So many innocent onetime starter homes, built on credit and striving, now in foreclosure. The holding company writes it off as a loss. And unless some crusading neighborhood association acts as a sentry, no one’s watching the house anymore. In essence, it belongs to nobody—or to everybody. Because once a house becomes worthless and unwanted…it’s everybody’s problem. Everybody’s crime scene.

As both a policy researcher and a Clevelander, I know these realities first hand. The city was home to over 40,000 vacant housing units in 2010, or nearly 20% of its stock. Several of these units were across a street from me, the result of a foreclosure on a rental investment purchased during housing inflation heights. Tenants were kicked out around 2009. The place sat empty, but I soon noticed people constantly disappearing into the back of the building. Drug activity I thought. Then one day I found a pile of hypodermic needles on my front lawn while cutting the grass. I have a child. The very real effect of blight acted as a drain on my property value, not to mention my quality of life.

And while I stayed in the City of Cleveland, many don’t. Cleveland lost 17% of its population from 2000 to 2010. The population decline (which is a long-term trend)—combined with the subprime mortgage crisis—created for unprecedented amounts of oversupply. Often, with both banks and homeowners walking away, the vacant structure devolves into blight until it becomes “a disamentiy effect”, which in plain-speak simply means living near something nobody would want to, with the unappealing prospect monetized in the devaluation of the house’s market value.

This disamentiy effect has been quantified. For instance, my colleague Nigel Griswold found that in Flint, MI each abandoned structure within 500 ft. reduced a home’s sales price by 2.27%. A study by Thomas Fitzpatrick of the Federal Reserve Bank of Cleveland showed an additional property within 500 ft. that is either delinquent or vacant reduces prices by 1.3%. In low-poverty areas the effect is greater: 4.6%.

Of course the larger problem is the broader economic effect, as depreciation goes beyond a lower return on investment and gets at household net worth. Specifically, according to the Census Bureau, household net worth declined 20% from 2005 to 2010 (40% since 2007). Of this decline, 76% was attributed to a loss of home equity. Minorities were hardest hit, with average Black household equity falling from $70,000 to $50,000 and average Hispanic household equity falling $90,000 to $40,000.

Such declines in net worth have swelled the number of Americans stuck in precarious economic conditions. A recent report called “Living on the Edge: Financial Insecurity and Policies to Rebuild Prosperity in America” found that nearly half of Americans are “liquid asset poor”, meaning “they lack the savings to cover basic expenses for three months if unemployment, a medical emergency or other crisis leads to a loss of stable income.”

Such economic figures are alarming, and they call for intensive solutions aimed at reconstituting the American middle class, if only to achieve a broader economic recovery outside of the investor class. One such solution could entail a large-scale strategic demolition of “zombie properties” in America’s hardest hit areas, such as the Rust Belt.

Why demolition?

It is simple, really: by removing the disamentiy effect you are giving the value of the surrounding houses a chance, and there is initial empirical proof that this does in fact occur. Specifically, in his examination of Flint, MI, Griswold found that Genesee County’s demolition investment was paying off, with $3.5 million of demolition activity producing $112 million in improved surrounding property values. Not a bad ROI, and it’s a return that positively affects homeowners, investors, and government alike.

The question remains: why isn’t there a concerted effort to once and for all excise the hundreds of thousands “zombie properties” that are draining value from the American economy?

The reasons are varied, but one in particular relates to a lack of empirical proof that demolition has a definitive monetary impact. One current study, spearheaded by Jim Rokakis of the Thriving Communities Institute, aims to fill the gap. The study, headed by Nigel Griswold, myself, and the Center on Urban Poverty and Community Development at Case Western Reserve University, was partly conceived out of a September 2012 interagency meeting on Residential Property Vacancy, Abandonment and Demolition in which—after hearing pleas from a largely Midwestern contingent—officials from Federal Treasury issued a challenge: show through robust empirical means that demolition (1) retains value on nearby properties, and (2) decreases the likelihood of future foreclosures. If the results prove definitive, Treasury suggested they could make a federal strategic demolition initiative a reality.

Of course the operative word here is “strategic”, as bulldozing for the sake of bulldozing does not a solution to a crisis make. As such, the intent of this research is also to help those on the ground ascertain where an investment in demolitions could pay off most. For example, there are properties—particularly architecturally-rich properties with high intrinsic value—that should be preserved and shuttled down another path. As well, there are areas in cities in which population decline is shifting ever so slightly. The area I had lived was one of them. And the house that was once vacant across from me has been renovated and is now home to a number of tenants. Thus, the authors of the study are cognizant of the contextualization that exists in various hardest hit cities, and so recommendations will be matched with an understanding as such.

That said, the study is currently ongoing, and while the results are as yet unclear—and in fact may not be robust enough to convince D.C. to act—the effect of “zombie properties” on the financial and mental well-being of regular Americans is anything but uncertain.

As a Clevelander, I know this all too well.

Richey Piiparinen is a writer and policy researcher based in Cleveland. He is co-editor of Rust Belt Chic: The Cleveland Anthology.

Beautiful? Behold the Most-Used Real Estate Listing Words

By Lauren Beale – LA Times

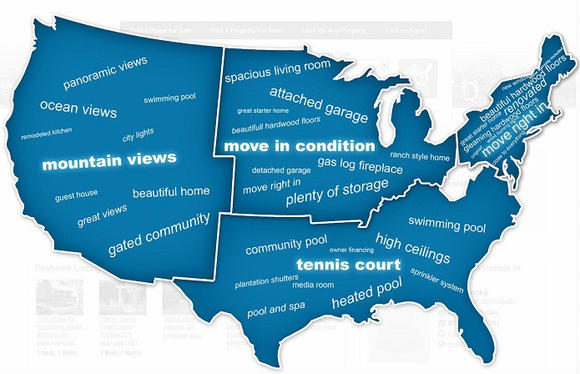

“Beautiful,” “ocean views,” “mountain views” and “gated community” are among the most popular keywords used to advertise homes online to West Coast home buyers, a recent study shows.

Nationwide, “beautiful” was the most frequent word in listings last year, according to a study of 300,000 listings conducted last year by Point2Homes, an online listing and property data portal.

“Hardwood floors” took the No. 2 spot and “stainless-steel appliances” came in third.

Among regional differences, East Coast listings were more likely to include the phrases “move right in,” “renovated” and “gleaming hardwood floors.”

In the New York City area, “closet space,” “sunny” and “oversized windows” were words used by agents whose homes sold fastest. Such features would appeal to buyers in cold-weather climates with winter coats to store and a dearth of sunshine.

Adjectives play a role. “Soaking tub” had more appeal than “bath tub,” and “private storage” topped “public storage.”

And terms differed by price point. “Beautiful” attracted average-income home buyers, but “private” appealed to the wealthy. Other terms used in the $5-million and up segment of the market included “guest house,” “wall of windows” and “wood-burning fireplace.”

SubZero topped the list of preferred brands, followed by Viking, Miele, Bosch and Whirlpool.

Home Improvement gets a Makeover: Homeowners are being choosier about which projects they undertake

By Kelli B. Grant – Market Watch

No longer content with new cabinet pulls or a fresh coat of paint, homeowners are beginning, again, to dabble in home remodeling projects.

Contractors say they’re getting more requests for upgraded kitchens and bathrooms, as well as home additions and major improvements that cut energy bills and reinforce structures against storms. It’s a significant shift from recent years, when homeowners were focused on only vital home repairs, “preserving the investment you had,” says Steve Melman, the director of economic services for the National Association of Home Builders. The NAHB’s forecast expects a 2.4% increase in remodeling spending this year among single-family-home owners. Harvard University’s Joint Center for Housing Studies has a rosier outlook. Residential spending on additions, remodels and other major home improvements for October 2012 through September 2013 is expected to tally $145.5 billion, up 19.6% year over year, according to a January report.

Even as remodeling rebounds, however, consumers are looking for ways to save. Prerecession-style, “blowout” renovations like creating a master bedroom suite or multiroom home addition pushed the average remodel tab to between $250,000 and $350,000, says Justin Mihalik, the second vice president of the New Jersey chapter of the American Institute of Architects. Today, the average for bigger projects runs about $100,000 to $150,000, he says — and many people are spending far less. Four trends that are reshaping remodeling:

Cash Beats Credit;

Homeowners are largely capping the budget at whatever they’ve saved up. That’s because financing isn’t as readily available as it was during the last remodeling boom — nor can people easily wrap the costs in when refinancing a mortgage, says Bill Shaw, chair of the NAHB’s Remodeler Council and owner of Houston-based firm William Shaw & Associates. Not only has paying in cash led to less expensive projects; it has also fueled the trend of mini remodels, where homeowners tackle, say, just the kitchen cabinets, with the intention of getting new appliances or flooring later, says Sean Murphy, DIY expert for home improvement retailer Build.com. “It’s easier on the wallet,” he says. But consumers should still plan out the whole project in advance, to avoid extra work and costs down the line from elements that don’t match up, such as new cabinets that won’t fit the new, bigger fridge.

Livability, Not Resale Value:

Unlike in boom times (or during the “house-flipping” craze), there’s less focus now on the added value a remodel might bring at sale. For virtually every residential remodeling project, “if you sell within a few years, you’re not going to recoup 100% of the cost of that project,” says Melman. According to Remodeling Magazine’s 2013 Cost vs. Value Report, the typical recoup is just 60.6%. That’s up nearly three points from 2012 — and represents the first increase since 2005. With more consumers thinking about long-term livability, experts are getting more requests for smaller-ticket projects that don’t typically add value at sale anyway, such as mudrooms, innovative kitchen storage and outdoor spaces. Older adults who have rethought selling have also created a bigger market for aging-in-place renovations such as grab bars, step-free showers and even elevators, says Tom O’Grady, chair of the National Association of the Remodeling Industry’s strategic planning and research committee and owner of Drexel Hill, Pa.-based O’Grady Builders.

Practical Upgrades:

Premium prices for energy- or water-saving appliances and fixtures have come down over the years, making those upgrades more attractive for long-term-minded homeowners. Annual savings for a low-flow or dual-flush toilet average $50; a water-conserving faucet, $220, says Murphy. Energy-efficient roofs, siding, windows and doors are equally popular projects, says Mihalik. (Currently, homeowners can claim a credit for 10% of the cost, up to $500 total, of qualified projects, including insulation, water heaters or roofs. Projects must have been completed during 2012 or 2013. Find details at Energystar.gov ( energystar.gov ). Storm-proofing upgrades, such as wind-resistant roofing, built-in generators and basement drainage, have also gained traction. “It’s exploded since Hurricane Irene in 2011,” Mihalik says. The hope, he adds, is that the investment will help homeowners avoid or limit damage in future years, and maybe cut their insurance bills. But even consumers who aren’t specifically looking for energy-efficiency or storm-proofing may find they need to budget for them. Depending on where you live, upgraded building codes now often require some such features.

Casting a Wide Net:

During the fourth quarter of 2012, remodelers reported a 3.9% increase in inquiries over the previous quarter, according to the NARI. But the number of bids that turned into actual jobs was slightly behind, up 3.5%. “It’s taking much longer to close a sale,” says Shaw. Where boomers might talk to two or three contractors at most, younger couples are meetings with at least twice as many. Recently, Shaw says, he met with a homeowner who had initially reached out to 20 contractors before soliciting bids from seven. “That’s unheard of in previous years,” he says. Experts say plenty of contractors left the industry during the downturn, but work is still limited enough that it’s worth the effort to shop around and get multiple bids. Homeowners’ best bet is still referrals from friends or family who have had work done, says O’Grady. “In the downturn, we lost an awful lot of remodelers that didn’t use the best business practices,” he says. “Anybody that’s low-balling a number today? Either they don’t know their costs or they’re going to come back with a tremendous number of change orders.”

Lumber Poised to Surge with Housing, China Demand: Capital Economics

By Myra Saefong – Market Watch WSJ

U.S. benchmark prices for lumber could rise around another 25% this year, according to Capital Economics, which added lumber to its coverage of agricultural commodities on Monday.

“We think that the price of lumber could rise further this year and possibly reach fresh highs, as three key factors which forced prices higher over 2012 have further to run,” said Tom Pugh, commodities economist at Capital Economics, in a note.

The resurgence in the U.S. housing market was “pivotal” to the recovery in lumber prices last year and “we expect this resurgence to continue,” he said. North American production is at its lowest levels since the 1980s. And “booming import demand from China” will continue to put upward pressure on prices.

On Monday, lumber for March delivery was trading at $352.20 per 1,000 board feet on the Chicago Mercantile Exchange, down $6.60, or 1.8%. Futures prices jumped more than 50% last year to end 2012 at about $374, according to FactSet data.

Data released this month on U.S. home sales hasn’t been very upbeat. On Monday, data showed that U.S. pending home sales fell 4.3% in December.

A report last week on sales of new single-family homes showed a 7.3% fall in December. But for all of 2012, the government estimated that 367,000 new homes were sold, the highest level since 2009.

“Large falls [in lumber prices] are not likely until near the end of 2014 as some mills reopen, increasing supply,” said Pugh.

A Glimpse of Home Building’s Future

Tiny generators, vanishing walls and refrigerators that heat water are showcased at the International Builders’ Show

By DAWN WOTAPKA and ROBBIE WHELAN – WSJ

Bioethanol candles that heat an entire room. Refrigerators that pour hot water. Glass doors that slide around curves.

Bioethanol candles that heat an entire room. Refrigerators that pour hot water. Glass doors that slide around curves.

At the annual International Builders’ Show in Las Vegas this week, tens of thousands, suppliers, distributors and builders convened to examine new innovations in home-building materials, appliances, fixtures and technologies.

The mood was optimistic: Construction of single-family homes climbed 18.5% in December from the prior year. The annual sales pace of new homes was on track to be 23% higher last year than the record low in 2011. And a number of exhibitors who sat last year’s show out, such as GE Appliances, were back in force.

The new designs highlighted the changing priorities of today’s homeowners—and could point toward a new set of standard home features. Generators, increasingly seen as a home essential, are getting smaller. Kitchen appliances have a greater ability to multitask. And the standard electrical outlet could be going the way of the dinosaur.

GE’s Café French Door refrigerator

Sure, it was exciting when refrigerators started dispensing water and ice—crushed and cubed. But GE Appliances says its Café French Door refrigerator is the industry’s first fridge that can quickly heat 10 ounces of water. There’s also a filter that promises to remove traces of pharmaceuticals.

Price: $3,200

Like a Fireplace Without the Smoke

Don’t call it a fireplace. An Australian household-goods company dreamed up these torchlike decorative appliances, which burn denatured alcohol—or bioethanol—to produce flames as high as 8 to 10 inches. EcoSmart Fire products usually come in fish-tank-like enclosures, but some are free-standing pieces of furniture. They emit a surprisingly high amount of heat, capable of warming a whole room, and can burn for between seven and 24 hours. Many of EcoSmart’s pieces are portable, and not considered fireplaces under most building codes in the U.S., making them legally acceptable for even most rental apartments. They produce no smoke and won’t damage walls or ceilings in the rooms where they burn. Price: $400 to $11,000

Small Box, Big Power

As big storms continue battering the nation and power grids continue to age, more consumers want their own generators. Today’s power units are increasingly compact. GE Generator Systems is showcasing its new 8kW generator, which it says boasts the smallest footprint in its class. The units can be placed as close as 18 inches to the home, making them usable in denser urban areas.

Price: $2,199

The Outlet Killer?

The era of mobile phones, tablets and portable games has made plugs prime real estate when it comes time to recharge, leaving little space for things that have long needed power. Leviton, of Melville, N.Y., has added two USB ports to its wall box—allowing heavy tech users to cut out the “middleman” device of a charger and plug phones and tablets right into the wall.

Price: $20

Sauna Fever

The sauna market is heating back up following the housing crash as higher-end buyers splurge on the heated rooms most associated with the spa culture.

Finlandia Sauna of Portland, Ore., allows buyers to select their size and wood type and decide if they want the unit incorporated into a bath or pool area or to function more as a stand-alone room. Europeans are big buyers, as are the health conscious, says Terri Tarkiainen, controller of the family-run business started in 1964. Sales are strong in New York—particularly Brooklyn—Florida, the Midwest and California. Price: Starting around $5,000

The Rise of the Elevator

Amid a shift away from one-story ranch houses and toward multistory, multigenerational houses, elevators are making a comeback in newly built homes. Residential Elevators Inc. builds small elevator units with interiors clad in mirrors, leather or high-end wood that can rise up to 50 feet—or five stories—and hold up to 950 pounds.

Price: Starts at $20,000

Grilling at Another Level

Fire Magic’s new Echelon grill is a high-tech smoker, rotisserie oven and barbecue all in one. Unlike many grills, which are purely gas-powered, the Echelon is combination gas and electric. The main grill lights using a hot-surface ignition system, much like the way a clothes dryer turns on, rather than the usual pilot light.

Price: $7,385

Jason Wu in the House

Jason Wu may be best known as the designer of inaugural ball gowns worn by first lady Michelle Obama, but he’s made a foray into home fixtures as well. At the builders’ show, Brizo, the high-end product line of Delta Faucet Co., owned by Masco Corp., featured a set of sleek, matte-black bathroom faucets and accents like towel rings and wall-mounted shelves, designed by Mr. Wu.

Brizo is marketing them as the ultimate in high fashion in the bathroom. The faucets, for example, display a cool blue light that changes to red when the water reaches the desired temperature. Price: $799

Rising House Prices, Not Stocks, Make People Feel Wealthy

by Michael S Derby – WSJ

As a key influence on households’ spending decisions, the health of the housing sector trumps stock-market moves, a paper released this week by the National Bureau for Economic Research claims.

The study, written by prominent economists Karl Case, John Quigley and Robert Shiller, refines their existing study of what is called the wealth effect. Case and Shiller are well known names, especially on housing issues. Quigley, another luminary, died in May, before the research’s publication.

Most economists and policymakers agree asset price gains can be big drivers of consumer spending power. Rising home or stock prices are generally agreed to increase consumer spending, while falling asset prices cut the other way.

That said, economists and policymakers have had a hard time quantifying the wealth effect. That’s problematic for many reasons, but it’s even more so due to the fact that the housing market’s crash and apparent recovery are considered central to the overall fate of the economy. To that end, the Federal Reserve is pursing a policy course deliberately aimed at driving up all manner of asset prices in hopes its actions will boost household spending to power better overall growth.

In the paper, the economists update their decade-old work, drawing on a wider and more up-to-date set of data ranging from 1975 to the second quarter of 2012. The broader information changes and clarifies what was once thought about the wealth effect’s influence.

There is “at best weak evidence of a link between stock market wealth and consumption,” the economists wrote. “In contrast, we do find strong evidence that variations in housing market wealth have important effects upon consumption,” they said.

“An increase in real housing wealth comparable to the rise between 2001 and 2005 would, over the four years, push up household spending by a total of about 4.3%,” the paper stated. Meanwhile, “a decrease in real housing wealth comparable to the crash which took place between 2005 and 2009 would lead to a drop of about 3.5%.”

This finding upends the old understanding that housing gains tended to push spending higher by a wider margin that home price declines depressed spending, the economists wrote.

The paper’s conclusion provides some additional hope that a nascent housing sector recovery could in fact be a meaningful contributor to a broader acceleration in growth over coming years. It may also explain why even as the stock market has scored strong gains in recent years on the back of extremely aggressive monetary policy, growth to date has been so middling and disconnected from the story told by equities.

A note from Deutsche Bank sees housing contributing strongly to a better economy. “The wealth effect on consumer spending could be substantial” this year, the bank told clients. “We are projecting home price appreciation of 5-10% in 2013, which translates into a further increase in household assets, i.e. wealth creation, ranging between $860 billion and $1.720 trillion.”

“Through its direct and indirect effects, the housing sector alone could potentially contribute as much as 2% to real GDP growth this year,” Deutsche said.