Is Fear of Commitment Delaying Millennial Homeownership?

Article from Realtor.com

By

Clare Trapasso

11:00 am ET

August 2, 2016

Much hand-wringing has occurred over the fact that millennials are putting off what used to be one of the main achievements of adult life: buying a home. This ownership-interruptus has been attributed to everything from fast-rising home prices to towering student loan debt to the ultrastrict credit requirements to score a mortgage.

But it might have a lot to do with their fear of commitment as well, suggests one study.

About 20% of those between the ages of 18 and 34 are likely to be afraid of the long-term obligation (30 years, for the full term of a typical mortgage) that buying a home with a partner represents, according to a recent NerdWallet survey. That broke down to about 34% of young men and, not surprisingly, just 10% of young women.

Meanwhile, only 4% of respondents ages 35 and older harbored the same fear, according to the survey. NerdWallet, a personal finance website, commissioned the survey of more than 2,000 adults, including nearly 1,300 homeowners.

“Home buying is a pretty big commitment. For most folks, it’s probably going to be one of the biggest purchases they’re ever going to make in their financial lives,” says Chris Ling, NerdWallet’s head of home buying and mortgages. “It’s not as simple as if you split up, one person can stop paying” the mortgage.

That may be a factor in why homeownership rates dropped to its lowest levels since 1965, at just 62.9%, in the second quarter of 2016, according to the U.S. Census Bureau’s Housing Vacancy Survey. Just 34.1% of millennials owned the deeds to their abodes—down from 39% in the second quarter of 2010, according to the survey, which looked only at 2010 to 2016 data.

But commitment wasn’t the only thing survey respondents were scared about. About 71% of participants of all ages expressed other concerns ranging from the home needing repairs, their not having enough money left over for other expenses, and the sheer magnitude of the financial commitment of becoming a homeowner.

And more than half of millennial buyers having trouble saving up for a down payment blamed student debt, according to a National Association of Realtors® report looking at housing data from July 2014 through June 2015.

Buying with a partner can ease some of the (financial) pressure of coming up with a down payment.

But whether a buyer is single or with a partner, saving up for that large initial payment, which can run from 3% to more than 20% of the cost of a home, is no easy feat. The average buyer deposited about $1,078.50 a month into a nest egg for three years to afford the purchase, according to the survey.

Some good news: Millennials are proving to be a bit better at saving than Generation Xers. About 42% of them were diligent savers—compared with 29% of those ages 35 to 54.

Average US 30-year mortgage rate declines to 3.43 percent

Originally published August 4, 2016 at 7:25 am Updated August 4, 2016 at 7:57 am

From The Seattle Times

The Associated Press

WASHINGTON (AP) — Long-term U.S. mortgage rates declined this week after rising for three straight weeks, continuing to lure prospective homebuyers.

Mortgage giant Freddie Mac said Thursday the average for the benchmark 30-year fixed-rate mortgage fell to 3.43 percent from 3.48 percent last week. The average rate is down sharply from 3.91 percent a year ago.

The 15-year fixed mortgage rate dipped to 2.74 percent from 2.78 percent last week.

Record-low interest rates this year have helped spur home purchases and boost the housing market. The Federal Reserve has been holding its key short-term rate near zero since 2008, and a statement from the Fed last week after its latest policy meeting had led many economists to conclude that a strengthening economy would lead the central bank to resume raising rates as soon as September.

But after a government report last Friday showed a surprisingly lackluster economy in the second quarter, many economists said a September rate hike was now probably off the table. The Commerce Department data showed that gross domestic product — the broadest gauge of the economy — grew just 1.2 percent in the April-June period.

To calculate average mortgage rates, Freddie Mac surveys lenders across the country at the beginning of each week. The average doesn’t include extra fees, known as points, which most borrowers must pay to get the lowest rates. One point equals 1 percent of the loan amount.

The average fee for a 30-year mortgage remained at 0.5 point this week. The fee for a 15-year loan also was unchanged from last week at 0.5 point.

Rates on adjustable five-year mortgages averaged 2.73 percent, down from 2.78 percent last week. The fee held at 0.5 point.

NEW HOME SECURITY SYSTEM IS SLEEK, SMART, AND BALANCES YOUR PRIVACY

From Builder Magazine:

FLARE brings German design and functionality to the American-dominated smart home security market.

By Kayla Devon

The home security market is largely dominated by US companies like NEST and Canary. Berlin-based BuddyGuard hopes to break up the monotony with some German engineering and design.

The company recently released its smart home security product FLARE, which looks similar to the Nest Learning Thermostat, but more UFO-shaped and featuring a 1080p HD camera at the center. Intended to be placed near the entrance of the home, FLARE relies on its camera to record entrances to the home (saving images to an online database) and recognize faces of its residents. A microphone also enables voice recognition as an added security measure.

The quick recognition prevents owners from having to drop everything in their arms to de-arm the system the second they walk in the door. FLARE also comes equipped with motion and temperature sensors, and can follow signals from owners’ smart phones to detect when someone is away or at home. Once residents are recognized and FLARE understands someone is home, it shuts off its camera and microphone to secure the privacy of its owners.

FLARE can also react to its environment to deter intruders, such as using its loud speaker to make noises as if someone was home or even sound a siren. It also connects to other devices in the home so users can set algorithms to turn on the lights or lock the doors when all residents have left. If anyone tries to tamper with the device, it sends an alert if it’s being moved or shut down.

The product is set to alert owners of potential suspicious activity in the house. If the owners don’t immediately respond, the system alerts an emergency contact, and if there’s no response there, FLARE immediately notifies local authorities of the situation.

All of this technology is in a 4.3-inch round device that is powered by rechargeable lithium batteries that last up to three weeks of normal use. Relying on batteries relieves the need for wiring and visible cords. The device can be charged overnight with a micro USB cable, or can be left plugged in to ensure it remains on if residents are away for a few days.

Currently FLARE costs $349 and is only available in Europe, but BuddyGuard starts shipping worldwide this November.

Building Strong and Stylish Porches

Attached is a re-hatched article from Professional Deck Builders on building strong and stylish porches. With summer in full swing, I thought this would make for nice reading!

TECHNOLOGY / VISION FOR THE FUTURE

Interesting Article from the July Issue of Builder Magazine:

PCBC keynote speaker identifies five high-tech advances that will shape home building’s future

BY JENNIFER GOODMAN

Q: Technology is exploding these days, faster than builders can keep up. What top five technologies should they pay attention to? My top five technologies for builders might seem like a strange list since some of these technologies are not specifically related to home building. That said, they are important for builders to understand. Here’s why:

3D Printing

This technology has made significant leaps and bounds in the past few years. In the first quarter of 2016, Oak Ridge National Laboratories showcased the first viable, fully 3D printed home suitable for everyday living. 3D printing will continue to improve and soon it will be possible for anyone to print just about anything. In the not-too distant future, I fully expect to see every house have a 3D printing room that will be used to print everyday objects like plates, cups, towels, etc.

Wireless Power

Imagine a world without cords or outlets, where devices of all shapes and sizes are able to operate continuously, and, as needed, have their batteries charged. This is the future of wireless power. And the future is much closer than people realize. Attendees at the PCBC conference in June got a peek into the future of home building courtesy of keynote speaker John Ellis. A former executive with Ford Motor Co. and Motorola, Ellis is the managing director of Ellis & Associates, a management consulting firm that serves clients in the automotive, consumer, connectivity and software fields. At PCBC, Ellis planned to address new technologies that are poised to influence the building industry such as the internet of things, 3D printing, nanotechnology, and more. Before the show, BUILDER talked with Ellis about his vision for the future. (For more on what the years ahead hold for home building, look for BUILDER’s August feature that will forecast the jobsite of the future.) One company promises commercially viable products before 2020. If that happens, it will have a profound impact on how homes of the future are built.

Nano-Particle Paint

This new technology is poised to revolutionize the world. Exceptionally hardened surfaces, self-cleaning surfaces, and dynamic-color changing surfaces are just a few examples of what is possible with nano-particle paint. We can imagine future homes that are never dirty, resistant to mold, mildew, and other such destructive forces, and able to change colors at the whim of the owner.

Autonomous Cars

While not directly related to the materials for home builders, autonomous cars are set to change the home building experience forever. The narrative goes as follows: As autonomous cars permeate the market, people will become more accustomed to the vehicle as a utility rather than a thing to own. Over time, the idea of personal ownership will be replaced with on- demand services. When that happens, there will be no need for garages, driveways, and maybe even streets. A future home in a world that is fully autonomous will be dramatically different than today’s homes.

Drones

This is yet another technology that is not directly related to home building, but it will have profound impact on the home of the future. We are moving quickly to a place where individual ownership of drones will be commonplace. Imagine sending your drone to the local Target or Costco to be loaded with goods that you purchased online and then it returns to your home. The future home likely will have a drone-pad similar to a helipad today.

Q: Your background is in the automotive industry. What can builders learn from the way cars are built and designed?

One of the biggest changes in the auto industry is the introduction of 3D printing. Once fully commercialized, it has the potential to fundamentally change the entire supply chain. No longer do we need to expend significant energy and cost to bring together thousands of parts from hundreds of companies. So, too, in the home building industry. When 3D printing is fully commercialized, home building will be changed forever.

UNDERSTANDING UNAFFORDABILITY

A look at the moving-target factors of household income, house price, and interest rates reveals parallel realities on what’s affordable and what’s not; and what’s economically sustainable and what’s not.

By John McManus

Housing data that’s supposed to help our decisions often surfaces as a series of moving-target clusters of supply, demand, and other stimulants measured over time and across many, many places.

Questions around affordability and its meaning, and attainability and its meaning, are big right now.

Most of us define affordability as a balanced, dynamic relationship between house prices and household incomes. Complexity enters the equation when time is factored in, as in the relationship of trending house prices and predicted household incomes.

Attainability, somewhat differently, speaks to payment power on, say, a monthly basis, to either save for or allocate to housing rents or mortgages.

The present flow of wealth, income, wherewithal etc. has begun re-engineering what both affordability and attainability mean as quantifiable measures of what people earn and their housing choices or options. Once, averages and indexes at least seemed to provide a fairly applicable quantification of what it took for households to rent or buy homes. Now, those same averages and indexes become more and more outdated, as they describe ever more constrained bands of household behavior. As age, income, wealth, education, and economic mobility gaps get deeper and wider, the terms affordability and attainability morph into hyper-segmented parallel Pareto realities–population barbells, with less and less middle ground.

Both the terms’ meaning speaks to Average Joes and Josephines working to achieve a baseline American Dream realized. However, the math reveals ways that middle ground may be eroding irreversibly, and in such a way that forward-planning residential real estate investments may need an earnest relook.

Zillow chief economist Svenja Gudell does a very good job at getting at this predicament in her analysis, “Housing Highs & Lows: How the Home Affordability Gap Between the Rich and Poor is Widening.”

Gudell’s piece looks at three tiers of household income levels and three tiers of house price levels, which together reveal one of the key conundrums of the housing market right now. She writes:

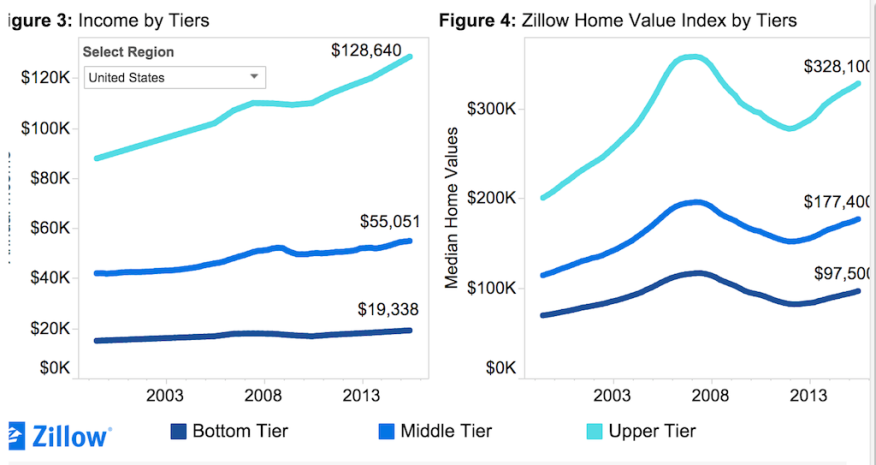

The reasons why mortgage affordability has suffered at the bottom at the same time as it has improved at the top comes back to two basic inputs used to determine affordability: Income and home price. Growth or contraction in either will lead to changes in affordability. And incomes at the top are growing more quickly than incomes at the bottom, while bottom-tier home values appreciate faster than those at the top-tier. Between Q2 2014 and Q2 2015, bottom-tier incomes grew 2.5 percent, compared to top-tier income growth of 3.5 percent (figure 3). Over the same period, bottom-tier home values increased 6.1 percent, versus 4.1 percent for top-tier homes (figure 4). Essentially, bottom-tier home values grew more than twice as fast as bottom-tier incomes, while top-tier incomes and home values grew at similar paces.

Net, net, those for whom affordability and attainability mean materially more when it comes to housing options–i.e. putting a wedge between doubling up and a household formation, for instance–are progressively losing purchase in today’s housing market. Whereas, those who have greater wherewithal, resources, and outlook can leverage that for greater return in value vs. their investments.

This is not a social or political judgment. This is an economic question. Especially, when, as Gudell does, you look at how interest rates–particularly, dirt cheap interest rates–impact the household income vs. house price relationship on a monthly payment basis. Gudell writes:

Low mortgage rates are a boon for home buyers, allowing them to borrow more money but pay less for it in interest charges each month. In other words, low mortgage interest rates are masking what could be a much worse affordability situation given rapid home value growth and anemic income growth. If and when mortgage interest rates begin rising again in earnest, many pricey markets could be in for a rude awakening.

Of course, if dirt cheap interest rates account in some part for the elasticity of house prices right now, then it stands to reason that they may also trace directly to inflated lot prices. This is what causes us worry, as modeling the moving targets–household incomes, house prices, and interest rates–is tricky enough right now, let alone 24, or 36, or 48 months down the pike.

Article Sourced from: http://www.zillow.com/research/affordability-2016q1-12763/