Job Openings and Hiring Increase in Construction

According to the BLS Job Openings and Labor Turnover Survey (JOLTS) and NAHB analysis, the number of open construction sector jobs (on a seasonally adjusted basis) rose to 214,000 in July, after establishing a cycle high of 215,000 in March. The March estimate represents the highest monthly count of open, unfilled jobs since May 2007.

The open position rate (job openings as a percent of total employment) for July was 3.1%. On a smoothed twelve-month moving average basis, the open position rate for the construction sector increased to 2.4%, a cycle high.

The overall trend for open construction jobs has been increasing since the end of the Great Recession. This is consistent with survey data indicating that access to labor remains a top business challenge for builders.

The construction sector hiring rate, as measured on a twelve-month moving average basis, ticked up to 4.9% in July.

Monthly employment data for August 2016 (the employment count data from the BLS establishment survey are published one month ahead of the JOLTS data) indicate that home builder and remodeler net hiring rebounded, as sector employment increased by 10,400. This gain comes after a recent period of hiring weakness, which has reduced the 6-month moving average of jobs gains for residential construction to just above 3,000.

Residential construction employment now stands at 2.597 million, broken down as 726,000 builders and 1.871 million residential specialty trade contractors.

Over the last 12 months home builders and remodelers have, nonetheless, added 132,000 jobs on a net basis. Since the low point of industry employment following the Great Recession, residential construction has gained 611,000 positions.

In July, the unemployment rate for construction workers stood at 5.9% on a seasonally adjusted basis. The unemployment rate for the construction occupation had been on a general decline since reaching a peak rate of 22% in February 2010.

75% OF AMERICANS FEAR BECOMING HOMELESS

Concerns over job loss lead to worries about housing security, a new study finds.

As a symptom of the rising cost of housing and fears of declining job opportunities, a majority of Americans worry about becoming homeless, according to a new survey.

With the August Jobs Report cited as the “worst month for job gains” of the year, The NHP Foundation, a not-for-profit provider of service-enriched affordable housing, polled 1,000 Americans to gauge their feelings about housing and job security. The survey’s highlights include the following:

75% of Americans are concerned about losing housing. When asked how concerned Americans are that they or a friend or relative could lose housing, 30% consider themselves “very concerned”, 27% are “concerned” and another 19% are “somewhat concerned.” Eighty-three percent of respondents are concerned about housing costs in America overall.

Over 65% of Americans are “cost-burdened.” Affordable housing is housing for which occupants pay no more than 30% of their income. Those who spend more than that on rent or a mortgage are considered cost-burdened; over 65% of Americans put themselves in that category.

80% welcome more affordable housing in their communities. With this many Americans feeling “cost-burdened,” it’s no surprise that 80% welcome affordable housing. Nearly 40% of those polled welcome affordable housing simply because “everyone deserves” it, while 25% cite the opportunity for “people to live in the community where they work.” Nearly 20% agree that affordable housing lets a wider range of individuals share a community, and 16% acknowledge affordable housing’s ability to revitalize neighborhoods.

Nearly 40% of respondents fear job loss will lead to loss of housing. In addition, those polled also felt that the following could lead to a loss of housing: Perceived lack of affordable options (28%), increased rents (24%) and retirement (21%).

“Job loss is the top concern to those who fear losing their housing; the two go hand-in-hand,” says NHP Foundation President and CEO Dick Burns.

What Do Consumers Really Think About Smart Homes?

The smart home industry has revolutionized the way we live and interact with our homes. Companies like Nest and Amazon have saved home owners money on their utility bills with energy monitoring devices and made daily life more convenient with home assistants like the Amazon Echo’s Alexa.

Custom Home sister publication BUILDER Magazine talked with Trevor Lambert, senior director of brand management at Vivint Smart Home, about the growing popularity of smart home technology. The Provo, Utah-based company is a front runner in the smart home industry. The company, which has its own line of smart home products in addition to partnerships with other manufacturers, builds, customizes, and installs smart home systems for consumers.

“When we talk about the smart home, it’s really those connected devices within the home that work together through an integrated system, whether it’s with security, automated locks, energy control, carbon monoxide monitoring, smoke and fire alarms, or other devices,” says Lambert.

From the most popular products that consumers are requesting to their biggest fears about automating their home, Lambert offers insight into the mind of a consumer in this BUILDER interview. Read it here at BUILDERonline.com.

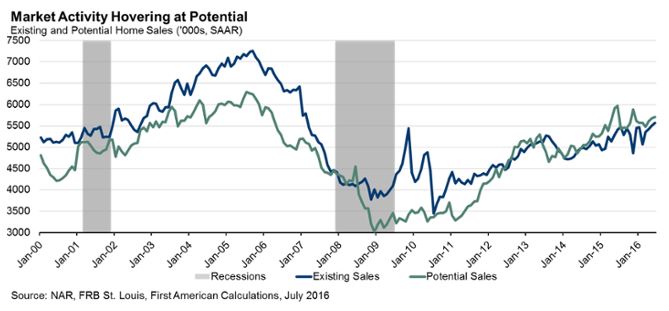

Positives Pushing Housing Market Near Potential

Housing in the United States is currently experiencing several positives, which have allowed the market to market to come close to its potential, according to data released Monday by First American Financial Corporation.

Housing in the United States is currently experiencing several positives, which have allowed the market to market to come close to its potential, according to data released Monday by First American Financial Corporation.

The First American Potential Home Sales Model reported gains in existing-home sales for the third straight month in July, which, combined with low interest rates, job and wage growth, and expanded credit availability has increased consumers’ confidence in the U.S. housing market.

Existing-home sales rose in June for the third consecutive month up to an annual rate of 5.57 million, which was an increase of 1.1 percent over-the-month and 3.1 percent over-the-year, bringing existing-home sales back up near early 2000s levels.

“Mortgage rates have continued to move lower, absorbing the impact of rising prices and giving consumers increased leverage and buoyed house-buying power,” First American Chief Economist Mark Fleming said. “The average rate for a 30-year, fixed-rate mortgage fell further in July, dropping to 3.44 percent from 3.57 percent in June. Except for a brief four-month period between October 2012 and January 2013, this marks the lowest mortgage rates have been since Freddie Mac began tracking mortgage rates in 1971,” said Fleming. “Global economic uncertainty and negative yields on government bonds overseas continue to drive demand for U.S. Treasuries, including the 10-year Treasury note, driving down yields and keeping mortgage rates low for U.S. consumers for the foreseeable future.”

In spite of the low mortgage rate environment and the recent increases in existing-home sales, First American’s Potential Home Sales Model for July shows that existing-home sales are slightly falling short of their potential by 1.3 percent, which computes to about 92,000 in annual sales. The underperformance gap narrowed from June’s rate of 1.8 percent, or 104,000 in annual sales.

First American reported an increase from June to July of 0.15 percent in market potential for existing-home sales, which computes to 8,000 in sales (an increase of 5.4 percent from July 2015). Overall, the market potential is nearly 90 percent higher than its low point reached in December 2008 at the depth of the crisis. The market potential for existing-home sales is still lower than its pre-recession peak by about 7.6 percent (about 433,000) from July 2005, according to First American.

“Low inventories still remain an issue, dropping to a 4.6-month supply, down from the 4.7-month supply seen in April and May, and from the 4.9-month supply of June 2015,” Fleming said. “The constrained supply in this sellers’ market continues to frustrate potential homebuyers and adds further upward pressure to nominal home prices, which rose an estimated 5 percent year-over-year in May, according to the Case-Shiller House Price Index. While nominal price growth remains strong, prices adjusted for the impact of income and interest rate changes on consumer house-buying power remain historically very low.”

This did not stop consumers from having a positive attitude toward housing, however.

“The Fannie Mae Home Purchase Sentiment Index reached a new high in July, up 3.3 points from June to 86.5, with large gains in consumers’ expectations for lower rates and continued house price growth,” Fleming said. “The survey also showed a growing number of consumers leaning towards purchasing rather than renting if they were to relocate. There was also a notable and similarly positive shift in sentiment amongst younger households.”

Click here for full details on First American’s report for July.

Montana Ranks Number 4!

BEST AND WORST STATES FOR A RICHER LIFE

New Hampshire is tops; Washington D.C. is not.

LOS ANGELES, Aug. 15, 2016 — Is there a place in America where families can have it all–a decent income, job security, safe neighborhoods, affordable child care and a good education, assuming, of course, the bread winners are capable enough to hold down a good job and absorb a good education?

To help make that answer more clear, GOBankingRates surveyed all 50 U.S. states and the District of Columbia on 12 different factors to find the places families can get the most out of life.

The factors:

- Jobs and income: median household income and state unemployment rate.

- Housing: median home listing price and effective state property tax.

- Lifestyle: state sales tax, annual child care costs, cost of groceries and school district grades.

- Healthcare: average family health insurance premium and percentage of employer contribution to employee health insurance.

- Safety: violent crime rates and property crime rates.

The facts:

The District of Columbia ranks the lowest on the list–at 51st–due in part to child-care costs coming in at $40,473 a year, more than twice the nation’s average. D.C. also has one of the country’s highest rates of violent and property crime. Housing and food are among the most expensive in the nation.

Although Mississippi (ranked 37th) has the lowest median income and a relatively high unemployment rate of 5.9%, the state has the lowest child-care costs in the country.

Vermont (ranked 16th) has the nation’s lowest rates of violent and property crimes.

Ohio (ranked 24th) and Indiana (ranked 28th) are tied for the lowest median home price—$140,000.

While Oregon (ranked 30th), Montana (ranked 4th), Alaska (ranked 36th), Delaware (ranked 3rd) and New Hampshire(ranked 1st) all boast 0% statewide sales tax, California (ranked 50th) residents are stuck paying a state-level sales tax rate of 7.5%.

While Maryland’s median household income is the highest on the list at $74,149 — more than $20k more than the country’s average — the state’s crime rate, health insurance premium and median home list price are all higher than average, pushing it down to number 25 on the list.

“There really is no ‘one size fits all’ formula for those trying to decide the best place to raise their families today,” said Kristen Bonner, lead researcher on the GOBankingRates study. “Our study examined some of the main concerns families have during this process and found that it is possible to live in states where the cost of living won’t drain your bank account and your children can still attend good schools in a safe environment.”

For the full list and further explanation, click here and then click on the words View All at the bottom of the copy.

Create a Kitchen that a Home Buyer Loves Living in

Photo Courtesy of Lita Dirks & Co.

What do you get when you combine hundreds of kitchen design options and a buyer who isn’t sure what they want, in an area of the home that has high emotional impact? The answer is often a very confused, frustrated and overwhelmed customer.

Here are some helpful tips that builders can use to influence the kitchen selection process and turn it from a hair-pulling process into a productive and fun experience that their customers will be raving about for years to come.

Surfaces

When it comes to surfaces, the consumer is desperate for design expertise! Many only select granite because they feel they are expected to. This is a huge opportunity for education and incorporating the home buyer’s tastes. The first question to pose to the customer is not about materials choice, it’s about acoustics and reflectivity: Do they want a room that is loud with a shiny finish or a room that is quiet with matte finish? Kitchens that are quiet with a matte finish tend to have seamless, integrated materials that absorb light and sound, while kitchens that are loud with shiny finishes are highly reflective of both light and sound and can appear brighter.

Islands

Regardless of a kitchen’s size, islands not only serve as focal point of the room, they also expand the prep and seating areas. Islands are often the connecting factor between the cooking area and the entertaining area. In the past, people congregated in the kitchen. Today, the island is the jewel in the ‘Great Room’ that not only works for the cook but provides a common area for communication, work, hobbies and homework. Islands are taking on different shapes and frequently have different finishes that serve as an accent to the rest of the kitchen. Add statement light fixtures above the island and “voila”—it takes center stage!

Zones

While walls have disappeared from the main living space of a home, zones still exist within the ‘Great Room’. These zones can include places for cooking, entertaining, dining, and relaxation, plus computer centers, back kitchens, pet suites, and drop zones (the place to put things down after coming in from outside). Some homes even extend these spaces outdoors through creative uses of large windows or moveable wall systems. In an open plan, where walls are not present, it is important to keep in mind functional adjacencies and the importance of forms. For instance, from the kitchen, a home owner should not have to walk through the living area to reach the dining table, and a person entering the home from the garage should not have to walk through the kitchen prep area to reach the drop zone.

Cabinets

Kitchen cabinets can increase efficiency in a kitchen if used properly. For standard nine- and ten-foot ceilings, wall cabinets should go all the way to the ceiling. For a clean, modern look, select cabinet door profiles with simple lines, and maintain one cabinet height throughout the entire kitchen. Cabinets are also a great place to integrate appliances and features for pets while maintaining a uniform look within the space. Overall, simplicity is key in today’s kitchen designs.

Color Choice

There isn’t one single color choice that will appeal to all home buyers. The key is to present options—but not too many. A good place to start is with contrasting colors. Select dark-colored cabinets and flooring and balance it with light-colored countertop and backsplash selections or vice versa. This is a popular way to add drama to a space without adding cost. Another option would be to select cabinets, counters, and flooring that are neutral, and add a bold pop of color either through paint, backsplash or both! Blues, greens and all shades of pink are all popular this year.