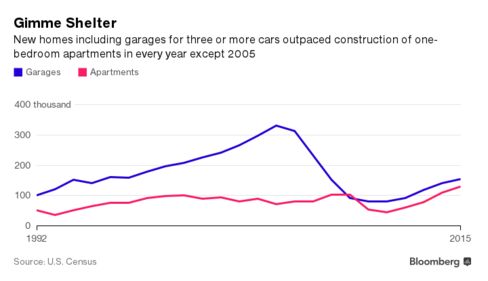

America Is Building More Three-Car Garages Than One-Bedroom Apartments

You’ll never be homeless in America if you’re a car.

Inventory has been a major theme of U.S. housing markets in recent years, as a shortage of homes for sale has pushed prices higher and low vacancy rates have increased rents. So it might be surprising to hear that Americans are building plenty of housing—for their cars.

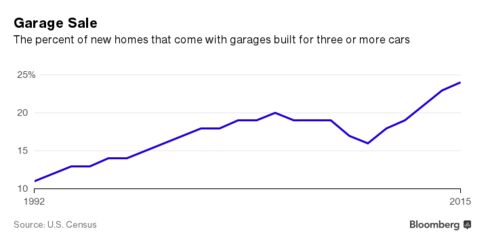

Twenty-four percent of new homes completed in 2015 included a garage with room for three or more cars, according to census data highlighted in a blog post last week by Robert Dietz, chief economist for the National Association of Home Builders. That’s the highest share since the Census Bureau started keeping track of large garages in 1992. In every year since the Census has kept track, U.S. homebuilders have built more three-car garages than one-bedroom apartments.1

Even at that rate, builders may be undershooting demand. One of three house hunters said they preferred a three-car garage, according to a recent survey conducted by John Burns Real Estate Consulting. That compares to 51 percent, who wanted a two-car garage, and 10 percent of respondents, who said room for one vehicle was enough.

“One of the interesting things we’re finding is that between Uber and public transport, a lot of millennials are deciding they don’t need a car, so parking becomes a less-important issue,” said Pete Reeb, a principal at the consultancy. “But we’re also seeing more multi-generational housing, where the kids are taking care of elderly parents or you have the new grad moving home after college, and now you have four cars where it might have been two before.”

In other words, the trend is mixed.

Even when buyers do prefer bigger garages, it’s not clear that they’re any likelier to own three cars. The share of households that own three or more cars has remained comparatively flat, ticking up from 17.3 percent in 1990 to 19.7 percent in 2013, according to data from the Bureau of Transportation Statistics.

An additional factor is driving the rising share of homes with garage space for three or more cars, captured in the chart above. In the years since the financial crisis, builders have focused most of their attention at the high end of the market, erecting larger, pricier homes. That’s led to bigger market share for larger garages, even as the annual construction of homes with three-car garages decreased from a peak of 331,000 in 2005, to 154,000 last year. As the market for smaller, cheaper new homes reemerges, fewer homes will feature garage mahals.

It’s hard to escape the irony that the U.S., which will need something like 43 million new housing units to keep up with population growth in the next 35 years, is using space to build apartment-size garages, even as trends in ride-sharing and self-driving cars cast a measure of uncertainty on American car culture.

There are, of course, many ways to fill excess space. Today’s oversize garages are tomorrow’s home offices and in-law apartments. The garage sale, meanwhile, is so called because it’s a method of emptying the junk out of a cluttered garage. In our current ashes-to-ashes, warehouse-to-warehouse culture, consumer goods enter the world from an Amazon fulfillment center and exit through the self-storage center in the industrial building next door. A giant suburban garage makes for a convenient way station.

2017 OUTLOOKS FOR HOUSING AND REMODELING

Young adults’ ‘wait-and-then-hurry-up” stage of household formation, family formation, and housing preference behavior is revving up.

Next year won’t be housing’s emancipating rebound we may have hoped for, but it’s also more than likely not going to be a stretch we’ll have reason to fear. For glass-half-empty types, 2017 housing measures will likely continue to underperform historical norm trends based on real demand plus pent-up demand. For the glass-half-full set, that solid and growing base of demand–and the big challenges to meet it–remain in the category of a champagne problem.

Of course, a big, honking unknown and possibly menacing variable is what the Federal Reserve does to rates for borrowed money, and how that flows through to mortgage interest rates. A positive-side plausible unknown is what could happen with household wage growth, particularly among younger adult households who need to shed college debt and get their noses above water to fully activate as a universe of housing demand. We’ll come back to this point below.

Otherwise, fundamentals will plod along, opportunity will concentrate in hotspot markets, constraints on housing supply–labor, lending, and lots–will retain their stubborn hold on development, and the somewhat-set template for continued moderate recovery across the residential new construction market will punch out a 2017 that bears a more than passing resemblance to this year and last.

For a thorough blast across the national bough of economic, demographic, geographic and business conditions forces in play, and their specific impact on housing starts, new home sales, and remodeling and home improvement expectations for 2017, have a look at the Metrostudy 4Q16 Housing Webcast, “Where Are We in the Housing Cycle?”

Metrostudy chief economist Mark Boud runs a clinic on statistical clarity and logical economic narrative. First, he deconstructs his own “model” of business assumptions and inputs one by one; then, he reassembles them into his projections for 2017. As a bonus, Metrostudy regional directors for the Mountain (John Covert) and Pacific Northwest (Todd Britsch) zero in on their respective regions for a deep-dive projection for what’s to come next in Denver, Salt Lake City (Eric Allen), Portland, and Seattle.

Among the noteworthy insights Boud extracts from his model is 1) that demand eclipses supply for as many as five more years, and 2) what that means for pricing. Here, Boud illustrates a demand-vs.-supply differential, and how that imbalance will net out to an almost 3 million home shortage–undersupply–by the end of next year.

Here’s the Boud forecast for housing starts in 2017 and 2018, a steady, glacial upward push to heights well below last-decade peaks.

For comparison’s sake, here’s a couple of other forecast estimates, this one spotlighting single-family starts expectations, from National Association of Home Builders chief economist Rob Dietz.

And here, the research team at Wells Fargo blends a series of real estate and trade group forecasts into a composite reading on how 2017 should play out for housing. By and large, everybody’s directionally in the same ball-park, with some perennially more optimistic than others.

Now, for a bit on the potential disruptors–to the bad and good–of these forecast assumptions. One is what happens, potentially as early as December, if and when the Federal Reserve executes its next step in tightening money supply by raising its Federal funds rates on borrowing costs. Here, Wells Fargo managing director and equity analyst for home builders Stephen East notes that the single biggest impactor of housing affordability is interest rates, not housing prices. He shows here that during the 2004 to 2006 housing boom run-up when prices were soaring, housing affordability as a function of the percentage of income a household would need to devote to monthly payments was much better then, than in the 1980 to 1983 period, when prices were not nearly as big a factor in affordability as abnormally high interest rates were.

On the other hand, another X Factor in predicting the level of housing demand has to do with household income trends, and the fact that they’ve stagnated for such a prolonged period of time.

The thinking here is that a “stealth” household income improvement trend may be emerging. The logic is this. More highly paid Baby Boom workers are retiring out of the labor force than early-in-their-career Millennials are moving into the workforce. Here’s a perspective on that from the ULI’s recent report, “Emerging Trends in Real Estate, 2017.”

The crossover point where more baby boomers are retiring than millennials entering the labor force is upon us. A Bureau of Labor Statistics (BLS) analysis released in December 2015 projected labor force change for the ten years ending 2024 as being only 0.5 percent per year. Emerging Trends has sketched the big picture in previous editions. The key change in the population cohorts from 2014 to 2024 looks like this: the number of Americans in the 25-to-34-years-old age group, the prime early-career working years, will be up by 3.2 million; meanwhile, the 65-to-74-years-old age group, those most likely to exit the labor force in retirement, will be up by 9.4 million.

Many organizations are having to accelerate compensation increases for younger associates, but they’re funding those increases by savings from attrition from among their older, higher-paid staffers.

So, that household income inertia we’ve been seeing, particularly among younger households, may be about to reflect a reality of resumed dynamic growth.

The “wait-and-then-hurry-up” stage of Millennial household formation, family formation, and housing preference behavior is about to redefine demand trends for the next five to 10 years.

12 Easy Steps to Prepare Your Home for Fall

Zillow Group • October 5

The days are getting shorter, and the nights are getting cooler. The kids are trudging off to school again with their backpacks and light jackets, and leaves are starting to fall from the trees.

Yep, it’s official: Fall is here. Now is the time to finish up any last-minute late-summer maintenance projects, and get your home and yard ready for fall.

Just follow our easy checklist, and your home will soon be clean, warm, and ready for the cool days to come.

Exterior prep

- Fix cracks in concrete and asphalt. Depending on where you live, these may be the last weeks this year when it will be warm and sunny enough to repair driveway and sidewalk cracks.

- Clean out the gutters. No one loves this job, but we all need to do it annually. A few hours of work can prevent big problems later on. And while you’re up on that ladder, visually inspect your roof for damaged shingles, flashing, or vents. You can also inspect the chimney for any missing mortar, and consider tuck-pointing if needed.

- Turn off outdoor plumbing. Drain outdoor faucets and sprinkler systems, and cover them to protect them from freezing weather to come.

- Start composting. If you don’t already have compost bins, now is the time to make or get some. All those accumulated autumn leaves will bring you gardening gold next summer!

- Clean outdoor furniture and gardening tools. It may not be quite time yet to put them away, but go ahead and make sure your outdoor furniture and gardening tools are cleaned up and ready for storage over the winter.

- Plant bulbs for spring-blooming flowers. A joyous and beautiful sign of spring is when tulips and daffodils start popping up everywhere. Plant bulbs in October, as soon as the soil has cooled down, to reap big rewards next spring. If you’ve never planted bulbs before, select a spot in your yard that gets full sun during the day.

![]()

Interior prep

- Prepare your furnace for winter duty. If you didn’t already do it last spring, consider getting your furnace professionally serviced in time for the cold season. At the minimum, though, visually inspect your furnace and replace the furnace filter before turning it on for the first time.

- Clean the fireplace and chimney. Clean out the fireplace, make sure the flue is operating properly, and that doors and shields are sound. Have the chimney professionally swept if needed. Now is the time to stock up on firewood!

- Keep the warm air inside and the cold air outside. Inspect your windows and doors. Check weather stripping by opening a door, placing a piece of paper in the entryway, and closing the door. The paper should not be able to slide back and forth easily. If it does, the weather stripping isn’t doing its job. Also, now is the time to re-caulk around windows and door casings if needed.

- Light the way. Bring as much light into your home as you can for the colder, darker months. To accentuate natural light, clean your windows and blinds, especially in rooms that get a lot of sunlight. Add lighting to darker spaces easily with new lamps. And consider replacing traditional incandescent light bulbs with energy-efficient bulbs.

- Create a mudroom. Even if you don’t have a dedicated mudroom in your home, now is a good time to think about organizing and stocking an entryway that will serve as a “mudroom” area for cold and wet weather. Put down an indoor/outdoor rug to protect the floor. A fun and rewarding weekend project is to build a wooden shoe rack, coat rack, or a storage bench for your entryway.

- Home safety check. Replace the batteries in your smoke alarms and CO2 monitors. A good way to remember to do this is to always replace the batteries when you change the clock for “fall back.” Create a family fire escape plan, or review the one you already have. Put together an emergency preparedness kit so that you are ready for winter power outages.

Once you finish with your autumn home checklist, you will be ready to relax in your warm, comfortable home, and enjoy the season.

Three Words

Most organizational performance issues–and inter-organizational ones–may actually be trust issues in disguise.

They’re three of the best words anybody can put together, whether they’re spoken out loud or not. “I believe you.”

In our business, too, where, quite normally, it takes a village of manufacturers, distributors, land sellers, land buyers, developers, local agencies and officials, inspectors, laborers, designers and/or architects, supervisors, marketers, sales people, accountants, to bring one residence into the pipeline we call new home supply. How many people’s word does it take to build a house? A lot.

“I believe you.” The motivation behind saying it; the reason it can be said or understood with confidence; the pay-it-forward meaning it supplies to us who want to be worthy of those words again, and again, and again.

Stephen M. R. Covey and Douglas R. Conant write here that, “that most organizational performance issues are actually trust issues in disguise.”

We’d venture to add that most inter-organizational performance issues are trust issues as well. Here’s what they note as the effect of the “virus” of low trust in an organization:

“The symptoms are wide-ranging dysfunction, redundancy, turnover, bureaucracy, disengagement, and fraud.”

You see, the words, “I don’t believe you” are powerful ones too. When those words apply, there are far fewer options, alternatives, and ideas to pursue, because those words narrow us down to reactiveness, fear. When one can say and mean, “I believe you,” the unbelievable can be trusted to be so; the unthinkable can be dealt with. Whereas, when the inverse is the case–“I don’t believe you”–what may come across as plainly plausible, even supported by evidence, loses credence. “I believe you” treads between fact and theory, real events and fiction. It holds, delicately, truth.

We’ve been reading a lot about disruptive innovation lately–the kind that can make long-successful companies fail, even as they execute at a high-level, and stay in close touch with their core customers.

The turf Joshua Gans explores in “The Disruption Dilemma” is not just what disruptive innovation is, but how incumbent, established players in a business sector can stay sustainably successful by learning to integrate innovation into their ways of doing their business, bringing their products online and to market, structuring their basic processes, from supply chains to the handing over of a title and keys of ownership in ways that can improve the product or introduce a new one, and do it profitably and to the delight of the consumer.

To manage disruptive innovation–whether it comes in its “demand-driven” form or its “supply-driven” mode–it turns out that good smart talented people are the only prevention and the only potential cure for an established “incumbent” company to stay relevant and successful when innovations–3D printing, robotics, off-site processes, etc.–cause a “discontinuity.” That’s when the way of doing things for a long time suddenly becomes “the old way.”

Many people we talk to expect that, as much as home building is a highly localized business and one whose outcome–a house–is basically what it’s been for scores of years, the business model of home building is susceptible to disruption. That’s why it’s critical to be able to utter, or infer, or understand those three words among ones or one we depend on as a “brain trust.”

Especially now, in a moment when rancor, insidious suspicion, and coarse hostility appear to gain currency with each hour’s news cycle, it’s important and it’s heartening we can turn to many souls in an everyday, run-of-the-mill work day in the life and say, “I believe you.”

A LOOK AT THE HOME OWNERSHIP OBSTACLES FACING MILLENNIALS

A panel of experts at HIVE agrees that millennials will eventually buy and home ownership will rise.

Millennials won’t just solve entry-level housing woes. At the HIVE Conference in Los Angeles, Dowell Myers, a professor of policy, planning, and demography in the Sol Price School of Public Policy at USC, said that an influx of millennials would help all segments of the market.

“We need millennials to… be there for boomers when they’re ready to sell,” Myers said.

But they have to pay off debt as well. While marriage is a big factor encouraging people to buy homes, the debt issue is canceling that out to a certain extent. And, rents have also become a major headwind—with a majority of millennials spending more than 30% of their income for rent.

“High rents are holding millennials back,” Myers said. “We’re not building enough multifamily rental for new demand.”

For Timothy Kane, CEO of MBK Homes, the home ownership rate forced a change in strategy. Instead of being a home builder, the company is now a provider of shelter. That’s because Kane began building apartments. But he agrees with Myers and acknowledges more needs to be done on that front to meet housing needs.

“We have a pretty big challenge to make rental that’s safe and affordable,” he said.

Former HUD Secretary Henry Cisneros and Svenja Gudell, chief economist for Zillow, contend that regulatory challenges also play a big role in stifling affordable housing. “Regulator intervention is very substantial,” Cisneros said. “Time is a huge issue. It takes three years to get housing done in Southern California.”

Eventually Myers thinks millennials will save money enough to buy homes. And, in the process, they’ll pull up the home ownership rate. Gudell agreed, saying they have relatively conservative views of home ownership. “They think it’s a good investment to buy a home,” she said. “They think it’s part of the American Dream.”

Sue Rossi, a Chicago Real Estate Agent with RE/MAX, also sees the home-ownership rate rising because she doesn’t believe it was inflated a decade ago. Instead of going with a traditional mortgage, she contends, they were forced into ARMs. If they had stuck with conventional mortgage vehicles, they might have never lost their homes.

“People were manipulated into the market,” she said. “They did not want to own homes. They were just sold the wrong product. The subprime loan market [ultimately] made the home-ownership rate lower.”

Cisneros thinks there are other factors holding millennials as well. Specifically, he said they want to remain flexible so that can move for jobs. But, ultimately, he admitted what everyone already knew—it’s hard to stereotype an entire generation.

“Millennials are not a monolithic group,” she said. “There are some who do well economically and some who don’t.”

/cdn0.vox-cdn.com/uploads/chorus_image/image/51130249/Story_20Image_Smart_20Home.0.jpg)

/cdn0.vox-cdn.com/uploads/chorus_asset/file/7197697/spot_smart%20thermostat.jpg)