GIFTS THAT KEEP ON GIVING

A note of thanks to home builders, developers, architects, manufacturers, planners, and tradesmen and women who make homes the American Dream.

Two words, the minute I heard them spoken, changed the year for me in 2016, and they’ve probably altered what remains of my career. They were part of a presentation at The Vine Conference–hosted by Greg Fuson in San Francisco in June, as part of PCBC offerings–by Bert and John Jacobs, founders of The Life is Good Company.

The two words are “get to,” as in “I get to go to work today and try to solve some problems I have no idea how to solve, with resources I don’t have, managing people whose morale needs a lift, in an industry whose future is cloudy at a time full of uncertainty.”

“Get to” as opposed to “have to” is the year-changing idea that came out of The Vine, a conference event that celebrates what home builders and developers do beyond the structures they fabricate on a plot of ground. These men and women in home building and development make communities. They build companies with a purpose that extends beyond blueprints, and floor plans, and take-offs. They get to do this work in times of astonishing prosperity and they get to do it when times could hardly be worse. Good times or bad, they find, like the Jacobs brothers, that it’s their attitude that matters. Inc. Magazine editor-at-large Leigh Buchanan profiled the Jacobs brothers and the $100 million business they built around a red-faced dude in a beret, with shades and a zillion-dollar grin, writing about the difference between “get to” and “have to::

That distinction is most clear in their chapter on gratitude, where they urge readers to think about their chores and responsibilities not as things they “have to do” but as things they “get to do” — because they have free minds and working bodies and live in a society where most basic needs are covered. Maximize what you have, preach most business books. Appreciate what you have, counter the Jacobs.

Now, BUILDER, by name, is about those who build homes and neighborhoods and how they can get better at doing it. The team at Hanley Wood and Metrostudy gets to come to work each day with an unrelenting surge of energy and curiosity that knows no bounds, aiming to help you do just that, get better at building homes and communities and earn a good living doing it.

In the process, we get to know some of you, and our lives improve because of that.

I was honored to know Ralph Farrell, who passed in February, and Isaac Heimbinder, who died in March of this year. To those who worked next to, across the desk from, on the job sites and in the conference rooms with these gentlemen, the losses still sting and the grief runs deep.

But we also get to see how people like Isaac and Ralph and their work and beliefs keep on giving to those they’ve left to continue the work. In the Atlantaarea, the North Gwinnett Church, a focal point of Ralph Farrell’s faith and commitment to people apart from his professional life, is moving ahead with plans for a new Community Family Life Center, with help and contributions from individuals and companies in the home building ecosystem, through a fundraising campaign you can link to, called Greater Things.

Too, we’ve been so profoundly touched by the work of Toll Brothers division president Christopher Gaffney, our 2016 Hearthstone BUILDER Humanitarian Award recipient, who gets to devote countless non-day-job hours to help teenagers at risk of homelessness. We had an update from Chris this week, who shared ways many of you have joined him in this crusade [I’ve edited his note slightly]:

We have opened up an Outreach Center in York, Pa. (Our first ever there) This will enable us to provide service to many more kids in the central part of the state. A local Shoprite renovated our cafeteria in the crisis center in Philadelphia and re-outfitted our kitchen with all new equipment. Again, making our shelter better and allowing us to service our kids by making the facilities feel more homey and less like a “shelter”. We will be expanding to our 4th floor, which will in turn provide an additional 25 beds for the kids.

Also, when I was speaking with the team from CertainTeed after the event, I had mentioned that Covenant House is looking to expand into Chicago. They have already provided me with some great intelligence and I was lucky enough to put them in touch with our liaison from Covenant House International who is heading that up.

Finally, … Ron Sozio, Client Manager for the Wells Fargo Home Mortgage Builder group in NJ and PA sprang into action. Wells Fargo Home Mortgage has a charitable contribution campaign. He obtained approval for Covenant House New Jersey and Covenant House Pennsylvania to be added to that campaign, which touches all their employees. All these folks can now donate through their weekly paychecks and/or their hard earned bonuses directly to Covenant House New Jersey and Covenant House Pennsylvania.

All of the above is on top of the numerous contributions that were made in my honor to Covenant House. Several of which I received at the networking event after the award ceremony. People whom I’ve never met in my life were actually walking up to me handing me checks for Covenant House.

Finally, we just finished the Executive Sleep Out which was held November 17th in 18 cities. In Philly alone, we saw additional people sign up, because of the coverage from the original BUILDER article as well as the follow-up one which ran on October 28, 2016. Some stats: Philly had 100 sleepers up from 60 last year and we raised $350,000. Nationally we raised over $6,200,000 and had 1200 sleep out.

At BUILDER, we get to know people like Christopher Gaffney, and Ralph Farrell, and Isaac Heimbinder, and our lives are improved from knowing them, witnessing their work–on the job and in their lives apart from their jobs–and telling the stories. This is the heart of an industry community whose purpose is to make homes that make the world a better place to live in.

If you know someone like that … whose gifts to others are great and keep on giving will you let us know by checking out this link? We have another Hearthstone BUILDER Humanitarian Award process under way, and we’re looking for your nominations.

Meanwhile, I now get to wish you and your families and friends a Happy Thanksgiving, and, on behalf of all of the team at Hanley Wood and Metrostudy, say “thank you” for being the community we get to serve in our day jobs.

THE NEED FOR SPEED

Why ‘abundant connectivity’ is a winning strategy for residential builders and developers

How much Internet connectivity does a homeowner or tenant really need?

It’s a question Google Fiber’s Peter Albers answers with a question.

“When I speak at industry events I always ask the audience, ‘How many people have had to deal with a crying child while a streaming video loads?’

Every Hand

“The hands of about 80 to 90 percent of the crowd shoot up. Then I ask ‘How many of you had to deal with a crying spouse because the streaming movie didn’t load fast enough?’ Every hand goes up,” he smiles.

Meet Peter Albers, Google Fiber’s head of real estate partnerships. It’s Albers’ job to work closely with large real estate owners and developers. Google Fiber’s one-gigabit (1,000 megabits) operating speed has transformed Internet service in a handful of American metro areas, such as Kansas City, Salt Lake City, Austin, and Atlanta. By contrast, the typical U.S. home makes do with about 1/20th of that speed.

How should a home builder or apartment developer understand connectivity’s impact on selling or leasing? Albers has some ideas.

Abundance Rules

“What homeowners want is abundance,” Albers explains. “They want to take Internet connectivity for granted, like water or electricity. You don’t have to turn the dining room lights off so you can use kitchen lights. Why should it be different for Internet connectivity?”

Why, indeed. Internet connectivity has swiftly escalated from a nice-to-have to an absolutely-must-have in the age of Netflix and YouTube. During peak Internet usage, Netflix and YouTube combine to take up 50 percent of all available worldwide bandwidth. Even more staggering is the fact that consumption is attributed to just 2 percent of Internet users, according to Albers.

$5,400+

What happens if 2 percent climbs to 3 or 4 percent? Connectivity is a difference-maker. Researchers at the University of Colorado and Carnegie Mellon University report fiber-optic connections in a $175,000 home add more than $5,400 to the home’s value.

Albers offers home and apartment builders and developers a heads-up.

“Residential builders and developers can add a competitive access conduit in their properties. That makes it comparatively easy for another, higher-speed Internet provider to provision the home or apartment,” Albers says.

Irvine Company Lesson

Albers cites the experience of the Irvine Company, the coastal California property developer that’s widely regarded as one of the world’s finest real estate master planning developers. “They’ve been installing connectivity pathways, including competitive conduits, since the 1980s in their developments. Their residents throughout Orange County are going to reap the benefits of that investment now and going forward.”

For now, home buyers and tenants will continue to place their bets on the best connectivity available. The rising surge of streaming TV, phone, intelligent personal assistants, and home management devices like the Nest Learning Thermostat illustrate the relentless need. Albers sees it firsthand every day.

“It’s amazing when people experience abundant connectivity. Once they have it, they will never, ever go back.”

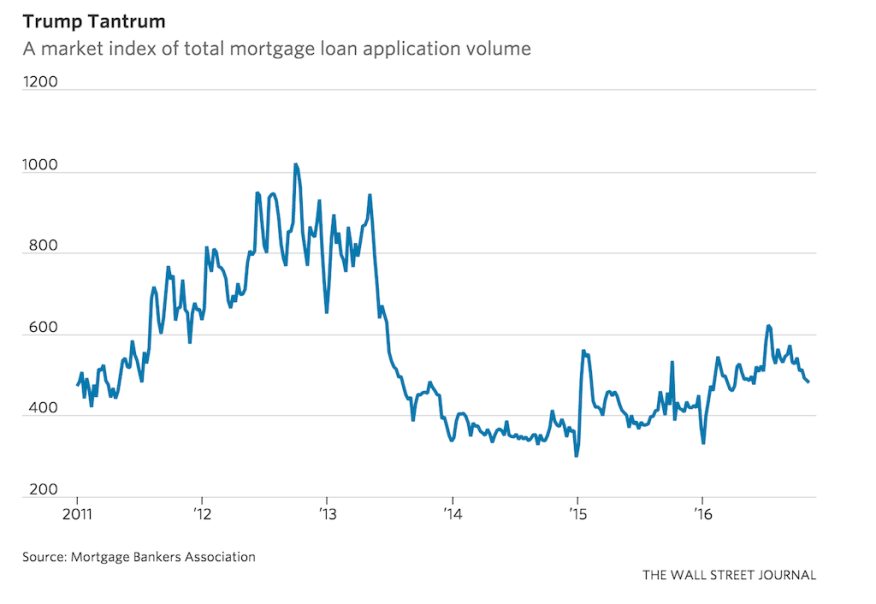

INTEREST RATE STRESS TEST

Historically dirt-cheap rates may be living on borrowed time.

A short note today, as I’m in Chicago, participating in our 13th Annual AHF Live! affordable housing event today and tomorrow.

Remember, interest rates–specifically as they bear on home mortgage rates and their impact on monthly payments for home buyers–were going to go up, sooner or later.

They rise, we’re told, for three principle reasons, normally. One is monetary policy, and the Fed is a veritable fishbowl of intent to track upwards with its borrowing rates. Two, is growth-fueled demand for borrowed money, which we like to see–as jobs, wages, and household expansion lead to people taking on debt against future earnings. Three, is inflation, which devalues money, and leads to lenders protecting themselves from risk of their funds shrinking in value by lending for shorter terms and higher rates.

However, there’s a fourth interest rate driver that also impacts interest rates, and it’s the one that’s cropped up as a stress-test to the housing recovery’s incipient expansion into the lower-priced, entry-level, and entry-level plus home offering.

Volatility.

So, let’s review. Higher than dirt-cheap rates have been expected. Their impact was and still is largely a guess for economists and analysts.

Here, Calculated Risk’s Bill McBride outlines the various and sundry ways “The Cupboard Is Full,” adding up economic data points on the latest retail spending, higher wages, demographics-fueled increase in working-age population, and housing demographics playing out pent-up demand. McBride writes:

“What could possibly go wrong?”

That there should be a period of intensified volatility amid rampant speculation about 1) what the President-elect intends to do, 2) what he will actually do, and 3) what meaning or impact those action items will have … is natural.

Fact is, though, we’re going to get a quick taste–like it or not–of how higher borrowing costs may affect would-be buyers.

Will they speed up their purchase process now, believing that rates are on a more permanent path upward? Or, will they tap the breaks, wait for the volatility to calm down and expect that rates will come back down?

That’s the question.

And we like McBride’s parting thought, too.

What could possibly go wrong?

Investing: the Money Blind Spot for Millennials

3 things parents of Gen Y kids can do to help

NEXT AVENUE BLOGGER

Credit: Getty Images

The Millennial generation — the kids of boomers and Generation X — seems to really get the importance of saving. But based on four new surveys I’ve seen, Millennials also seem to have a blind spot when it comes to investing.

If you’re the parent of a Generation Y son or daughter, I strongly encourage you to provide your child with a basic tutorial about the benefits of being a long-term investor. Or if you don’t feel competent to do it, I’ll offer a few suggestions at the end of this post.

4 New Surveys of Millennials and Money

The four new surveys are Fidelity’s second biennial Millennial Money Study (just out today); The Wisdom of Experience: Lessons Learned From Millennial, Generation X and Baby Boomer Investors from American Funds; the 2016 Advice Matters Survey from TIAA and the 2016 Wells Fargo Retirement Study.

Millennials are “taking the right steps to build a solid future and that’s a really good trend,” says John Sweeney, executive vice president of retirement and investing strategies at Fidelity. His firm’s survey of 305 Millennials between age 25 and 35 found that 85 percent have some savings, 60 percent are saving for retirement (up from 51 percent in 2014) and 59 percent have emergency funds that would cover 6½ months of living expenses, on average.

Only 44 percent of Millennials surveyed by American Funds call themselves long-term investors and understand that market fluctuations are natural.

Stumbling as Investors

But Millennials are stumbling on the steps to become smart investors.

In Fidelity’s survey, only 62 percent of Millennials said they have investment accounts. Worse, just 9 percent of Millennials said they see themselves as investors. “That’s a really low number,” said Sweeney. But it didn’t surprise him.

“There’s a mindset around being an investor that young people have to embrace,” said Sweeney.

That mindset includes understanding that volatility is just a natural part of the stock market and that stocks historically have outperformed bonds and cash, over the long term.

But only 44 percent of Millennials surveyed by American Funds call themselves long-term investors and understand that market fluctuations are natural. “That’s concerning to us,” said Heather Lord, strategy and innovation director at American Funds.

By contrast, 60 percent of boomers the firm surveyed see themselves as long-term investors. (American Funds surveyed 1,203 adults overall — boomers, Gen X’ers and Millennials.)

Picking Hot Stocks

What’s more, when American Funds asked what makes them feel smarter as an investor, only 43 percent of Millennials said “sticking with my investment strategy” (compared to 65 percent of boomers). And 12 percent of Millennials told American Funds that they think picking the next hot stock or market sector makes them “feel smarter as an investor.” Only 2 percent of boomers felt that way.

Similarly, Wells Fargo’s survey said that 59 percent of thirtysomething workers “focus more on avoiding loss than maximizing the growth of their investments for retirement.”

Many Millennials would love to be educated about investing, according to the surveys. But they’re either hesitant about talking about it with their parents or don’t have financial advisers.

The Disconnect With Parents

In Fidelity’s survey, although 65 percent of Millennials said their parents are “positive financial role models,” 34 percent said they were hesitant to discuss savings and investments with them. In 2014, only 24 percent of Millennials had such hesitancy.

Why the disconnect? “The way Millennials learn today is from their peers,” said Sweeney. “They want to find ‘people like me that make what I make and live in the city I live in.’”

The Millennials surveys show that many in this generation aren’t turning to financial advisers either.

In TIAA’s survey, 82 percent of Gen Y respondents said they were interested in receiving professional financial advice, but only 45 percent had. Yet when asked “At what age do you think you should first meet with a professional adviser?” 80 percent of Gen Y respondents said: before age 35.

“That’s a big gap” between the percentage of Millennials who’ve received financial advice and those who’d like to, said Daniel Keady, senior director for advice and planning strategy at TIAA.

Millennials and Financial Advisers

One of the biggest barriers preventing them (and older generations) from seeing financial advisers is that “many feel that if you have less than $50,000 in assets and modest income, they won’t qualify for advice,” said Keady.

That feeling, in many cases, is correct.

“Many business models for financial advisers don’t accommodate smaller balance clients,” Keady said.

There are a few financial planning firms, however, that either cater to middle-income clients or to Millennials in particular.

For instance, Garrett Planning Network charges hourly fees rather than a percentage of assets or through commissions, the way many planners do. And the XY Planning Network, comprised of fee-only advisers, specializes in Gen X and Gen Y, as its name suggests. It was co-founded by noted financial planner and blogger Michael Kitces.

Advice for Parents of Millennials

Three pieces of advice for parents of Millennials to help them become better as investors:

- If you have a financial adviser, see if he or she will meet with your Millennial child, too. Maybe you’ve seen the Edward D. Jones financial services firm’s commercial along these lines. “In some cases, advisers will advise children of their clients,” said Keady.

- If you don’t have an adviser, direct your Millennial son or daughter to online tools and websites that explain the basics of investing. “Online tools can help them get their arms wrapped around their savings goals and objectives,” said Lord. Next Avenue ran an article with some excellent resources for novice investors, such as the National Endowment for Financial Education’s site, Smartaboutmoney.org, and Morningstar.com, which has a few primers on mutual funds and stocks.

- And whether you have an adviser or not, talk with your kids about what you’ve done right and wrong as an investor. “Tell them what you could have done differently as a 25-year-old,” said Sweeney. This way, they’ll see that everyone makes mistakes and they’ll avoid repeating yours.

Bingo? Pass. Bring on Senior Speed-Dating and Wine-Tasting.

NOTHING about Mather’s-More Than a Cafe looks as if it’s aimed at people over 50. But the Chicago cafe, which could easily be mistaken for a large Starbucks, is much more than that, serving as a community hub, mostly for older people, with dozens of classes on topics like flower arranging, Egyptian history and digital safety.

In her six years as a member, Pat Knazze, 66, has taken line dancing and piano lessons and participated in over 50 seminars via Skype, including architecture classes that helped her qualify as a neighborhood docent.

As she ages, Ms. Knazze has also found another expected benefit: a caring group of neighbors who serve as a kind of substitute family.

“We’re social beings,” said Ms. Knazze, who is divorced. “And the cafe is a kind and loving group. I have multiple families that nurture me.” The Mather’s Cafe manager even attended Ms. Knazze’s mother’s funeral.

To appeal to baby boomers like Ms. Knazze, many community senior centers are getting up-to-date makeovers. There are about 11,500 senior centers in the United States, according to the National Council on Aging. They are increasingly offering everything from top-flight gyms to speed-dating sessions, wine tastings and Apple support groups.

Many are also shedding their names so that they can evolve beyond being seen as just places to play bingo. The senior center in Rochester, Minn., has become 125 Live, which just opened in a sleek, modernistic building with a teaching kitchen, big lap pool, pottery studio and a gym. Another in Minnesota is now Lakeville Heritage Center; it has yoga, Pilates and Zumba classes — and a motorcycle club.

“We have to move away from hot meals and bingo,” says Jim Firman, the chief executive of the National Council on Aging. “So there’s a lot of exciting innovation going on. The laggards will catch up or go away.”

Mather’s three Chicago cafes helped kick-start the transformation in 2000. They were inspired by Robert Putnam’s best-selling book, “Bowling Alone: The Collapse and Revival of American Community.” He talked about how people’s health and happiness were declining along with a sense of community, said Mary Leary, chief executive of the Evanston, Ill.–based nonprofit Mather LifeWays.

“So the cafes were conceived as a way to connect with others,” said Ms. Leary. “And it all starts with a cup of coffee.” Indeed, a bottomless cup of coffee costs only 95 cents at Mather’s Cafe, which also offers breakfast and lunch.

Mather’s Cafes take a holistic approach to aging, she said. Classes, aimed at adults 50 and older, include wellness, lifelong learning, fitness and entertainment. There are also telephone topics programs, such as chair yoga or eating well, for people who can’t attend. Innovative classes are devoted to edgier subjects like sexual identity and virtual reality. Fees are donation-only.

“We see aging on a spectrum,” Ms. Leary said. “Let’s help people stay active so they can age in place and connect with others.”

To spread its message, Mather’s holds workshops for other organizations. So far, people from 138 cities have attended and more than 40 other cafes have popped up, Ms. Leary said.

Like Mather’s Cafes, many senior centers are usually funded privately or by communities, so fees are typically nominal.

More a luxury club than a senior center, The Summit in Grand Prairie, Tex., charges $55 a year for adult residents 65 and older. The sunny 60,000-square-foot building has perks like an infinity edge pool, underwater treadmill and a hot tub. There is also a 100-seat movie theater, banquet rooms with full kitchens and an outdoor cafe with a grill.

“This is really an active adult facility,” said Amanda Alms, general manager of The Summit. “The city wanted to create a facility that was unlike any other.” Members have benefited by becoming more fit, finding artistic niches and making lifelong friends, she said.

For Wilfred Sanchez, 69, The Summit has become his home away from home. A Vietnam veteran who was exposed to Agent Orange, Mr. Sanchez has post-traumatic stress disorder and nerve diseases. So he uses The Summit’s pool for exercises like running laps or the underwater treadmill.

“PTSD makes me not want to go anyplace,” said Mr. Sanchez, who is also a retired information technology instructor. “But I don’t let it stop me.” Mr. Sanchez and his wife also visit the center to go to the movies, eat lunch and socialize with other veterans. “I’m so thankful,” he said.

Mr. Firman of the National Council on Aging says his goal is to transform the typical senior center into more of a longevity hub.

“There’s an evolution going on and a revolution as baby boomers age,” Mr. Firman said. “So we’re developing richer programming. We’re given the gift of longevity, so we have to spend it wisely.”

Many people are overwhelmed by the challenges of living longer, Mr. Firman said. “Health is complicated,” he said. “Finances are complicated. And there’s no playbook.”

The Senior Center in Charlottesville, Va., now includes a lifelong learning program on how to design a good life. The center also offers lots of ways to socialize, including singles gatherings, travel partner matches and three bands that members can join. There are also fitness classes, hiking programs and pickleball.

Peter Thompson, the center’s executive director, lamented the word “senior” in the name, though. “It’s a barrier,” Mr. Thompson said. “People don’t want to acknowledge that that’s them.”

The goal, he added, is creating centers that help people feel ageless. So a new center including features like a mind-body studio aimed at active adults is being planned.

Hansie Haier, 65, goes to the senior center often to socialize. She takes line dancing, yoga and tai chi. Ms. Haier, who is single, also teaches a weekly writing group there.

“The center helped me find my purpose,” said Ms. Haier, a retired psychiatric nurse who now writes short stories. “I’m constantly learning new ways of living. A good center helps keep the brain functioning. That’s really important.”

Isolation is a potential risk for millions of aging adults, said Shannon Guzman, a senior policy research analyst at the AARP Public Policy Institute. But new forms of social engagement are emerging in the digital world. Selfhelp Community Services’ Virtual Senior Center in New York helps homebound older adults keep in touch via computer: They can attend group museum tours, Shakespeare discussions or even take laughter yoga.

“We’re building an online community,” said David Dring, executive director of Selfhelp Innovations. “Seniors can create these cyberclassrooms.” They can also create ongoing virtual friendships.

Ms. Knazze says she feels deeply fulfilled and cared for at Mather’s Cafe. “Now,” she said, “I want to share that with others.”

The real reason insurance companies want to give you free ‘smart’ home devices

David Becker

David BeckerWhen your “smart” home is hacked, who is to blame — and importantly — who pays for it?

As connected items in our homes move beyond laptops and mobile phones to baby monitors, refrigerators, door locks, intruder alarms and thermostats, insurance companies are evolving along with them.

The insurance industry is increasingly incorporating these devices into home coverage. According to new figures from research firm Accenture, insurance pilot projects for connected homes increased from 9% in 2014 to 22% in 2015.

“There is a significant movement within the insurance industry now to see how they can leverage some of these connected devices to make people more insurable,” Eric Cernak, vice president and cyber practice leader for insurance group Munich Resaid. “Whether through subsidizing devices or providing better terms and conditions on these policies, there are a number of ways various companies are looking at encouraging these technologies.”

Some of those companies, like State Farm, pay for the installation of certain security services and offer customers discounted insurance coverage if they take measures like automating light and energy management from an app or use smart fire and water monitors. State Farm spokesperson Rachael Risinger said these measures are to help consumers prevent losses. One study showed that these measures can help insurance companies too: The installation of a smart fire detector, for instance, could save companies an average of $35,000 in insurance payouts.

“Research indicates home control and monitoring products help provide protection to the home,” she said. “State Farm envisions an intelligent home that increases policyholders’ awareness of what happens in their homes and empowers them to control and protect their family and possessions.”

These protective measures are becoming increasingly invasive: the provider’s “Connected Care” policy encourages the use of sensors to “make sure loved ones are going about their normal routine,” reminders to take medication, and fall-detection technology for elderly family members.

Although these products are being promoted, and even subsidized by insurance companies, they also come with their own risks. Many smart products are extremely susceptible to security flaws, leaving customer information vulnerable to hackers. Companies are working to encourage the adoption of these devices but have done little to address what will happen to customers if a security breach occurs, Cernak said.

“We have not necessarily evolved that far as an industry — we are seeing companies incentivize smart homes but what isn’t being addressed is the vulnerabilities of those devices,” he said. “A lot of these policies were written before the connected home was a concept, so the question is whether the language on the page covers what a current exposure would be.”

Cyber liability insurance is a growing area of coverage that is expected to triple by 2020. It is largely used by businesses and individuals with highly valuable data, particularly startups, but Christopher Dore, a partner at privacy law firm Edelson PC, said there is a demand for such coverage to be built into home insurance for the average consumer.

“There is monetary value assigned to data and it is personal property and the loss of which should be compensated — that is not something that has gained enough traction to move over to the very strict world of insurance,” he said.

Connected devices are also making home invasions less physically obvious, and therefore potentially harder to prove in the claims process. In the past, there was often evidence of a break in, whether it is broken glass or a busted-in door, but today the insidiously subtle process of a break-in could be hard for consumers to prove. Smart home owners filing insurance claims may face a struggle similar to victims of identity theft, who have to prove seemingly routine actions like withdrawing money from a bank account were not actually carried out by them.

The home monitoring devices that benefit insurance companies may ultimately hurt consumers when data tracking is used to identify trends and habits, Cernak said. Customers could be penalized for risky behavior like leaving a stove on and tracked to ensure they are using the smart devices they say they are.

“You could get to a point where insurance companies are saying they know you have a security system on your home, but you aren’t turning it on so they won’t give you a discount,” he said. “The convenience that comes with all of these devices also means they are capturing your day-to-day lives behind closed doors, and people forget about the value of that.”