A look at the moving-target factors of household income, house price, and interest rates reveals parallel realities on what’s affordable and what’s not; and what’s economically sustainable and what’s not.

By John McManus

Housing data that’s supposed to help our decisions often surfaces as a series of moving-target clusters of supply, demand, and other stimulants measured over time and across many, many places.

Questions around affordability and its meaning, and attainability and its meaning, are big right now.

Most of us define affordability as a balanced, dynamic relationship between house prices and household incomes. Complexity enters the equation when time is factored in, as in the relationship of trending house prices and predicted household incomes.

Attainability, somewhat differently, speaks to payment power on, say, a monthly basis, to either save for or allocate to housing rents or mortgages.

The present flow of wealth, income, wherewithal etc. has begun re-engineering what both affordability and attainability mean as quantifiable measures of what people earn and their housing choices or options. Once, averages and indexes at least seemed to provide a fairly applicable quantification of what it took for households to rent or buy homes. Now, those same averages and indexes become more and more outdated, as they describe ever more constrained bands of household behavior. As age, income, wealth, education, and economic mobility gaps get deeper and wider, the terms affordability and attainability morph into hyper-segmented parallel Pareto realities–population barbells, with less and less middle ground.

Both the terms’ meaning speaks to Average Joes and Josephines working to achieve a baseline American Dream realized. However, the math reveals ways that middle ground may be eroding irreversibly, and in such a way that forward-planning residential real estate investments may need an earnest relook.

Zillow chief economist Svenja Gudell does a very good job at getting at this predicament in her analysis, “Housing Highs & Lows: How the Home Affordability Gap Between the Rich and Poor is Widening.”

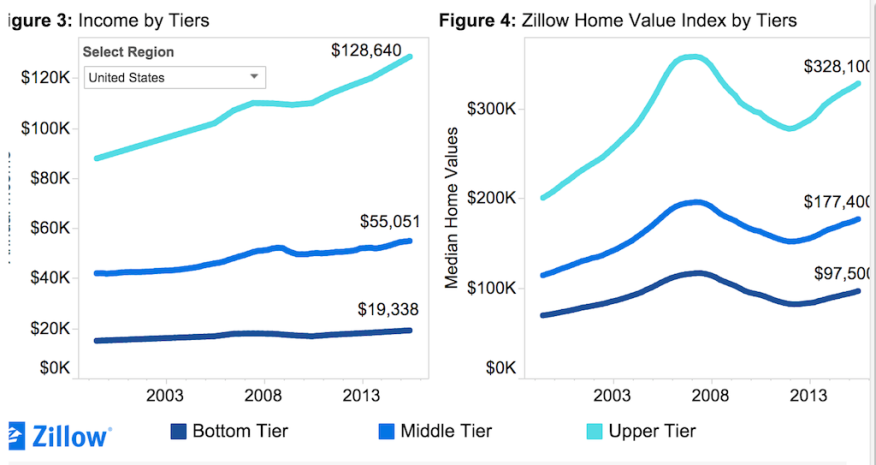

Gudell’s piece looks at three tiers of household income levels and three tiers of house price levels, which together reveal one of the key conundrums of the housing market right now. She writes:

The reasons why mortgage affordability has suffered at the bottom at the same time as it has improved at the top comes back to two basic inputs used to determine affordability: Income and home price. Growth or contraction in either will lead to changes in affordability. And incomes at the top are growing more quickly than incomes at the bottom, while bottom-tier home values appreciate faster than those at the top-tier. Between Q2 2014 and Q2 2015, bottom-tier incomes grew 2.5 percent, compared to top-tier income growth of 3.5 percent (figure 3). Over the same period, bottom-tier home values increased 6.1 percent, versus 4.1 percent for top-tier homes (figure 4). Essentially, bottom-tier home values grew more than twice as fast as bottom-tier incomes, while top-tier incomes and home values grew at similar paces.

Net, net, those for whom affordability and attainability mean materially more when it comes to housing options–i.e. putting a wedge between doubling up and a household formation, for instance–are progressively losing purchase in today’s housing market. Whereas, those who have greater wherewithal, resources, and outlook can leverage that for greater return in value vs. their investments.

This is not a social or political judgment. This is an economic question. Especially, when, as Gudell does, you look at how interest rates–particularly, dirt cheap interest rates–impact the household income vs. house price relationship on a monthly payment basis. Gudell writes:

Low mortgage rates are a boon for home buyers, allowing them to borrow more money but pay less for it in interest charges each month. In other words, low mortgage interest rates are masking what could be a much worse affordability situation given rapid home value growth and anemic income growth. If and when mortgage interest rates begin rising again in earnest, many pricey markets could be in for a rude awakening.

Of course, if dirt cheap interest rates account in some part for the elasticity of house prices right now, then it stands to reason that they may also trace directly to inflated lot prices. This is what causes us worry, as modeling the moving targets–household incomes, house prices, and interest rates–is tricky enough right now, let alone 24, or 36, or 48 months down the pike.

Article Sourced from: http://www.zillow.com/research/affordability-2016q1-12763/